- CIN - U70200PN2023PTC224016

- Yes@terkarcapital.com

- +91 7414973455

Rajiv, a seasoned business owner, needed substantial funds to expand his operations. Instead of disrupting his cash flow, he decided to leverage his commercial property to secure a loan. The process involved property evaluation, documentation, and approval before receiving the required funds. With expert guidance, Rajeev navigated the loan against property procedure smoothly and secured financing at favourable terms.

To comprehend the procedure for a loan against property, let’s examine Rajeev’s case.

| Turnover of company | 30 Cr |

| The amount required for a new order | 8 Cr |

| Mortgage Available | Companies Premises |

| Company Industry | Steel Manufacturing |

Since the order is huge and he is in lacks funds, he is thinking about what can be done to borrow finance. The deal is going to make his company shine, but the amount required for manufacturing is massive. Perhaps his CIBIL rating is creditworthy and hence can easily get a loan from any Bank, NBFC, or Financial Institution. As he is unable to decide as to whom to approach for the cause. While searching Financial Consultant, he came across Terkar Capital. He approached us to fix a meeting to understand the procedure for a loan against property.

Our executives understood the case and started working on it. Here’s a detailed LAP execution process. After a proper analysis, we suggested taking a Loan against Property.

| Business commencement year | 2012 |

| Amount Disbursed | 8 Cr |

| Total Execution Time | 7 working days |

| Customer Service Experience | 4.5/5 |

Once the proposal was put in by the borrower we strongly worked on it and executed it thoroughly. The loan procedure for a loan against property was entirely done by our expert team and it got sanctioned in 3 days. Rajeev received the funds 7 days after our first meeting and was very much satisfied with the required process. Rajeev cracked the deal and his company is growing rapidly and is in a strong position too. Since then Rajeev approached us for all his finance from us.

Learn about Myths About LAP Facility, here.

Rajeev, the owner of ‘Rajeev Steels Private Limited’ in Pune, faced a financial challenge when he received a lucrative order but lacked the necessary funds for manufacturing. With a creditworthy CIBIL rating, he sought a solution and discovered Terkar Capital.

We suggested availing of a Loan Against Property instead of unsecured debt products. Terkar Capital’s expert team swiftly processed and sanctioned the loan within 3 days. Rajeev received the funds in just 7 days, enabling him to seize the opportunity and propel his company’s growth.

Book a call to arrange working capital for your business!!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

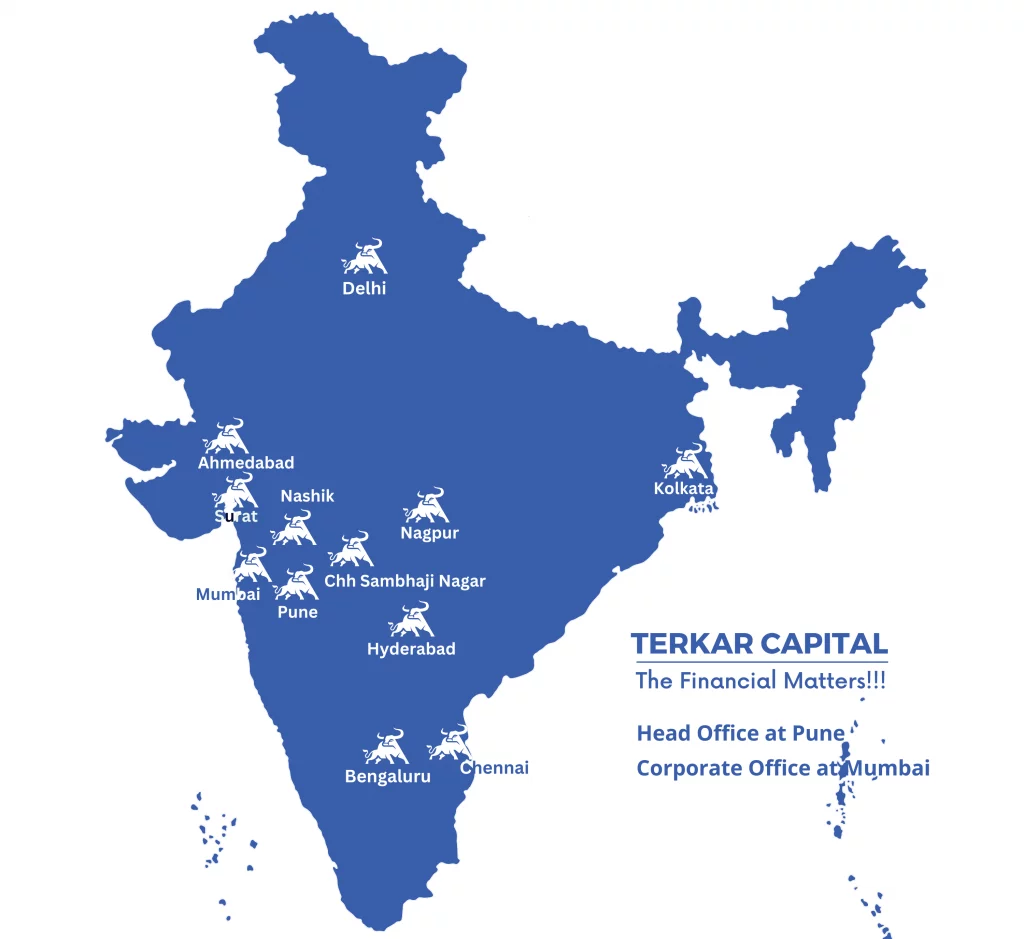

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…

Note: All formal communication is solely via designated official emails.