Today, the calculations of businesses have changed and are changing drastically every day, like never before. Now is a great opportunity to explore business at the international level, whether it be product manufacturing or the services you provide. However, there are several challenges associated with dealing with products in the international market, such as the challenge of working capital, payment assurance, credit periods, and more.

So, we are here to offer you trade financing solutions that facilitate international trade by providing funding and managing financial risks.

Trade Finance is one of the financial instruments that helps you to bridge the gap between you and your export business working capital. Many companies do not indulge in the export of goods and services due to the challenge of working capital and the surety of the payment. Terkar Capital is a Trade finance company that facilitates international trade finance solutions. Thus our clients won’t have a working capital crunch and can easily get international exposure.

Facilitate International Trade

Helps Businesses Manage their Cash flow better

Competitive Interest Rates

Reduces the Risk of Non-payment

Easy access to Working Capital

To be eligible for Trade Finance, you must meet certain criteria. These criteria may vary, but some of the essential requirements include:

Terkar Capital, a leading trade finance company in India, specializes in providing a hassle-free arrangement for trade finance services. We always stand by business owners and the business community to minimize risks and help them achieve the best possible rewards. When dealing with international trade and exporting various goods, we can assist you with Trade Finance.

Learn in detail, how Terkar Capital process Trade Finance here.

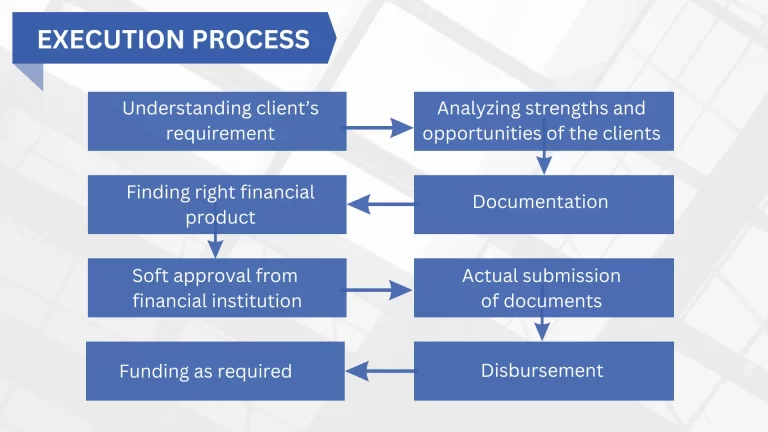

Here’s the execution process to avail of Trade Finance Solution smoothly at Terkar Capital.

We cordially track the deadlines and make our quality tangible, while executing finance projects well ahead of time.

We comply with the highest professional confidentiality standards. All client information is discussed in strict confidentiality.

We find you the right lenders with similar terms and the lowest rate of interest.

We create a stable ownership structure for financiers by establishing a secure transaction process.

We are building our reputation through reliability, integrity, and honesty. We connect to our clients on personal grounds that include transparency and liability.

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024