Overview

What is factoring funding?

While running a business, there might arise the need for immediate cash flows for managing working capital finances like paying utility bills or dues, etc. There can be a situation where the seller has sold the goods on credit to the buyer. The buyer promises to pay the money after a specified credit period. In such a case the buyer’s money gets locked in for a particular period. So, he is in lacks funds to proceed with further orders. To avoid this crunch, there is a financial instrument available in the market where sellers can raise finance using these accounts receivable which is called Factoring Funding.

Factoring Funding

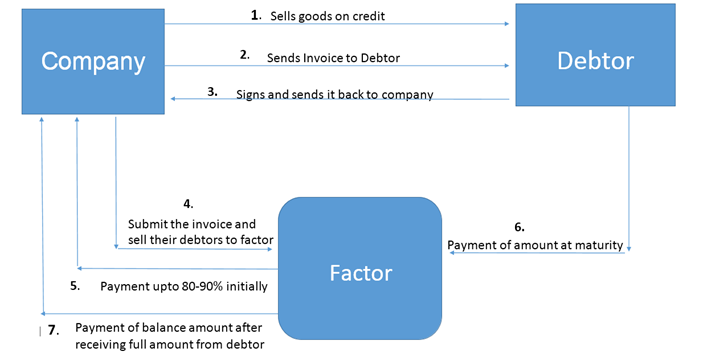

Factoring Funding is the financial instrument or debtor finance. In this, the seller sells its accounts receivable to a third party called ‘factor’ at a discount. There are three parties involved in such a transaction. A seller, A buyer, and A factoring company. In simple words, it is selling unpaid invoices for the requirement of instant cash. This helps the company with its short-term cash needs and manages money immediately.

The factoring company pays 80-90% of the invoice amount immediately. Thus, it solves the problem of working capital. The remaining amount is kept unpaid by the factoring company. It depends upon the creditworthiness of the customer or the risk involved in the transaction. That is paid after deducting the discount. The factoring company is more concerned about the credibility of the debtor than the customer as he is the person who will pay money at maturity. Factoring is availed to domestic as well as international customers.

What is factoring funding? How to avail of factoring services?

Benefits of Factoring:

The factoring process is quick as compared to loans which may take a longer time to disburse the funds. So, it arranges the funds easily for the borrower. It solves the issue of a cash crunch.

Due to the availability of factoring services, the working capital issues are resolved and the business cycle continues.

Since the factoring funding is not a loan, hence it does not add liabilities to the balance sheet of a company. So, It ultimately reduces the burden of debt. It is simply selling a company’s assets to a factoring company for immediate cash.

There are no long terms repayment periods like loans in factoring. The tenure depends upon the credit period of unpaid invoices sold by the company.

The overall process of factoring in funding is easy. The documentation is also hassle-free. So, one can avail the cash in barely one or two days.

Factoring Funding is a financial instrument of Unsecured Working Capital Finance. Hence it is collateral-free. Micro and Small Enterprises in the service sector do not have assets for collateral, hence CGTMSE will best suit them.

Disadvantages of Factoring:

Generally, the costs of factoring findings are high as compared to other funding options. Fees or charges depend upon the tenure of the factoring. But we at Terkar Capital, arrange a reasonable cost of borrowing for our customers.

The customer has to inform his client about the procedure of factoring. There is a lack of confidentiality in the process.

The factoring companies’ payment criteria depend upon the risk involved in the transactions. The lower the risk, the higher will be the chances of qualifying for the factoring procedure. The factoring company verifies the creditworthiness of the debtor, as he will be the person responsible for payment at maturity. Hence, the debtor should possess good credit in repayment.

Types of Factoring

Recourse factoring is a method where a seller sells its invoices to a factoring company. In case of non-payment of an invoice, the seller holds the obligation and has to repay the same on behalf of his debtor.

In non-recourse, it is just the opposite. The seller holds no obligation in case of default in payment by the debtor.

Understand the execution process of Factoring funding from the case study.

How factoring companies work?

Why Terkar Capital?

Terkar Capital offers loans to MSMEs, including Factoring Funding, a solution to address immediate cash flow needs. Factoring Funding allows sellers to sell accounts receivable at a discount, providing instant cash and managing short-term finances. Benefits include quick access to cash, business cycle continuity, no debt liabilities, flexible terms, an easy process, and no collateral requirement.

FAQs on Factoring

1. What is the tenure in factoring?

The tenure in factoring is lesser as compared to other funds. The tenure in factoring is totally dependent upon the credit period of the transactions. The period is for 30/60/90 days, etc as per the requirement of the customer.

2. Does factoring help International Clients?

Yes, there are no geographical limits for factoring. In fact, it will give more benefits to International Customers as one will get exposure to LIBOR plus Spread.

3. What is the eligibility criteria for Factoring?

Note- The eligibility criteria vary as per the geographical limits and the requirements of factoring companies. Below are a few of the criteria:

1. Customers should have unpaid invoices to factor in.

2. The customer and his debtor should have a good track record.

3. The customer’s company should have a specified annual turnover, as per the requirement of the lending institution.

I didn’t know that there were cycles to business funding. My wife and I are looking to get funding to start a business. We’ll have to find investors fast.

Thank you for your input. Definitely raising the funds to run and start the business is possible. Kindly share your contact details or write to us at yes@terkarcapital.com. So we can understand your requirement and can work to raise the funds for you.

Thank You.

Best Regards,

Team – Terkar Capital