Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

Factoring finance is an unsecured debt product. It is an excellent solution that efficiently manages each process phase Let’s explore the effective implementation of the Factoring Case Study from Ajit’s case.

Ajit Jain owns an IT Industry named ‘Info-Solution Pvt Ltd’ situated in Pune. His Previous year’s Net Profit is Rs 9.2 Cr. He has been running this business Since 2011. His business is leading into IT Services and is earning a huge profit. Since he always faces a working capital crunch, he constantly needs funds to run his company efficiently. He has recently provided software services of Rs.20 lakhs to a renowned Company and has accepted the credit period of 60 days. Meanwhile, he has received another order for which he lacks funding. The new order is amounting to Rs.12 lakhs which is again quite a huge order.

| Company Name | Info-Solution Pvt Ltd |

| Commencement Year | 2011 |

| Turnover | Rs 9.5 Cr |

| Mortgage available | None |

| Industry Type | Service Industry |

After analyzing the company’s balance sheet, he came across that the company does not have any assets that can be given as collateral. Thus, helpless to secure funding. He is confused and unable to decide the exact way for funding. While discussing with one of his friends, he came across Terkar Capital. That is one of the best funding solutions providers in India. Soon he fixed a meeting with us.

Our team of experts examined the case and asked for companies’ financial statements. After studying the financials, we decided to provide a Factoring Funding Solution to his company. The balance sheet had no asset for collateral but showed heavy Account Receivables i.e. more than the required amount. Mr. Ajit was unaware of the concept of finance like Factoring and was contented after getting assistance.

Factoring is the financial instrument or debtor finance in which the seller sells its accounts receivable to a third party called ‘factor’ at a discount. There are three parties involved in such transactions: the customer, the debtor, and the factoring company. In simple words, it is the selling of unpaid invoices for the requirement of instant cash.

| Financial Instrument | Factoring |

| Total time for execution | 3-4 days |

| Amount Disbursed immediately | 80-90% of the invoice amount (depends upon credit score) |

| Lock-in period (credit period) | 60 days |

| ROI | 5-15% |

| Company ratings for services | 4.5/5 |

(Note- The ROI varies as per the market conditions)

We chose the most suitable Lender and forwarded the required documents of the customer to them. Soon, they transferred 85% of the invoice value as their debtor was creditworthy. After said credit period the debtor executed the payment and Mr. Ajit received the remaining amount less their discount/fees. Although there are discounting charges/fees for factoring, they provide around 80–90% of the cash instantly. The amount depends upon the creditworthiness of the debtor as he will be the responsible person for payment at maturity.

Apply for Factoring Funding here.

Once the proposal was put in by the borrower we executed it thoroughly. Our team of experts arranges suitable funding options and executes the process effortlessly. Since then, Mr Ajit has approached us for all his funding from us. Factoring Funding is a top solution for businesses, providing comprehensive organization throughout the process. Our Factoring Case Study offers valuable insights into real-world scenarios and success stories.

Get a free CIBIL score & Report here.

Book a call today to explore our factoring finance solutions!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

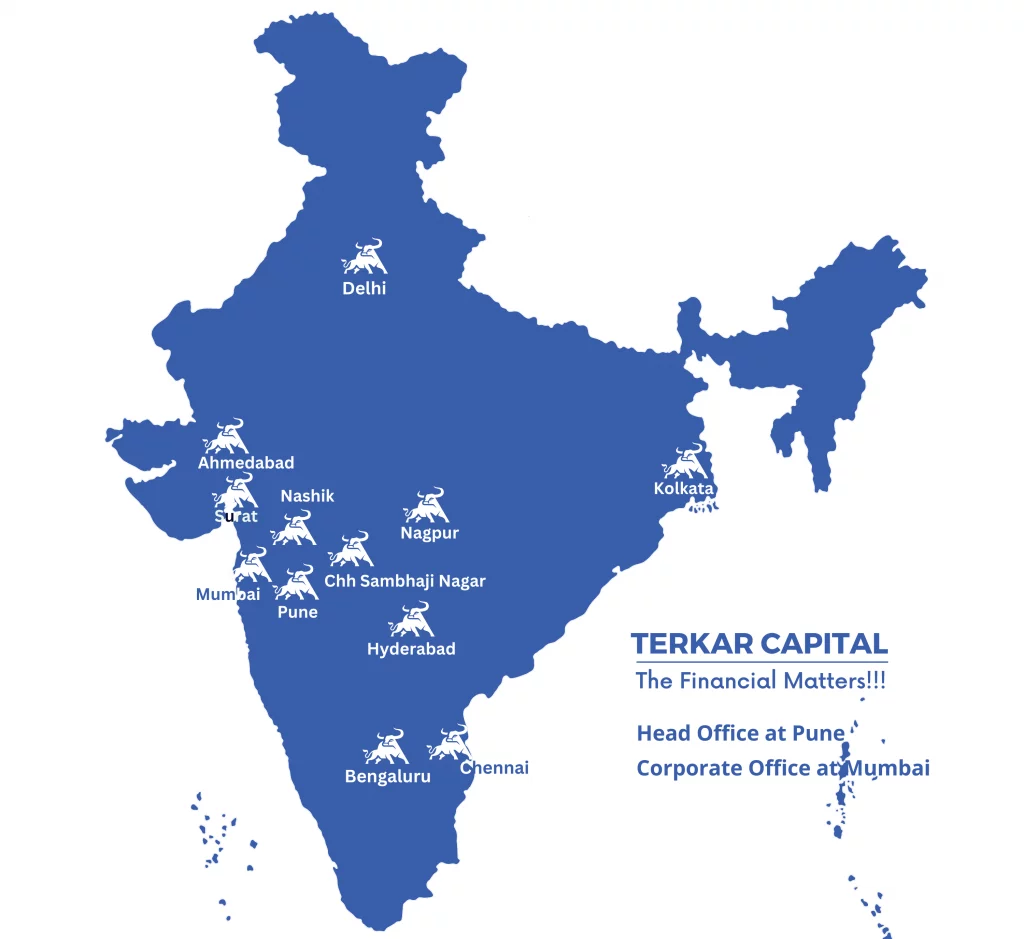

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…