We specialize in arranging financial instruments tailored to your unique business funding needs. Our expert team offers comprehensive financial consulting for a wide range of instruments, ensuring that you have the support you need to make informed decisions. We believe in supporting and creating opportunities for businesses across India.

So, Let’s work together to find the perfect financial instruments for your business.

Discover how corporate finance plays a vital role in maximizing your company’s value and growth. From funding strategies to resource allocation, our expert team utilizes powerful financial tools and SWOT analysis to prioritize and enhance your financial resources

As a business decision-maker, you understand that working capital is crucial for sustained growth and meeting market demand. Whether you’re in manufacturing, services, or trading, having sufficient working capital is essential to thriving in today’s competitive landscape

Expensive medical equipment can make it tough to provide quality healthcare. So, Healthcare providers can lease, finance, or partner to get the equipment they need. Hence, We at Terkar Capital offer flexible, affordable financing options for medical equipment.

Unlock the unlimited financial potential for your business with debt syndication funding. Expand your operations, invest in new equipment or fuel growth – whatever your goals, we’ve got you covered. Say hello to endless possibilities for your business with us.

Expand your business internationally and overcome the challenges of working capital, payment security, and credit periods. We offer Trade financing and expert management of financial risks to ensure seamless international trade.

Our expert team understands the creative vision behind every piece of land and works tirelessly to turn your ideas into reality. Trust us to handle all your financial needs ethically and efficiently, so you can focus on building the estate of tomorrow.

Get your working capital quickly and fuel your business growth with bill discounting. Submit your invoices to financial institutions with minimal documentation and receive prompt payment. Boost your cash flow and propel your company forward.

Whether it’s US Dollars, Euros, or other global currencies, we offer flexible loan options tailored to your business needs. Secure your loan by mortgaging your property or utilizing it for export/import business, LC, BG, and more.

Factoring is the service where a business sells its debtors to the factoring company. Generally, factoring companies take charge of the debtors and release the funds to the company. So, gain access to working capital support without the need for collateral.

Tap into your idle sugar stock and convert it into cash with our expert assistance. We understand the complexities of securing funds against sugar pledges, so we simplify the process for you. So, benefit from minimum interest rates and a hassle-free experience.

Discover the power of LC Discounting, a modern and hassle-free non-fund based credit facility, designed to meet your business’s working capital needs. Benefit from the flexibility and ease of LC Discounting, available through your trusted banking partner.

Our expert financial solutions are tailored to meet your business needs and foster trust between buyers and sellers. From fund-based options to non-fund-based credit facilities like Bank Guarantees, we have got you covered.

Overcome business hurdles effortlessly with this long-term loan secured by your valuable property. Lending institutions consider it the safest option, making it easily accessible for borrowers. Experience the freedom to conquer financial challenges with confidence.

Manage your business effectively by securing working capital finance. Simplify your financial management and keep operations running smoothly with the difference between current assets and liabilities. Ensure seamless purchasing and operational payments with working capital finance in India.

Owing to the rise of businesses in the country, there are several options available for loans in the Indian Debt Market. Lease rental discounting is one such loan. So, explore the wide range of loan options available in the Indian Debt Market to fuel your growth with a steady income source.

The government-backed scheme is designed to fuel the growth of micro and small enterprises. From boosting existing enterprises to empowering new ventures, the CGTMSE scheme has revolutionized the manufacturing sector and breathed new life into the Indian economy.

Recognizing the significance of education in shaping individuals’ lives, we believe that schools are the vital foundation for success. Thus, Terkar Capital offers accessible funding solutions tailored specifically for schools, enabling you to contribute to this noble cause.

We provide hassle-free loans for Micro, Small, and Medium Enterprises (MSMEs). As an expert in financial solutions, we understand the importance of supporting this vital sector, which contributes nearly one-third to India’s economy.

Overcome short-term hurdles like machinery purchases, employee payments, pending bills, and stocking up on inventory. With no collateral required, this loan option is perfect for business owners seeking financial flexibility and convenience.

Getting a machinery loan is an effective way of enhancing the business as it offers a higher level of eligibility, and quick financing. We focus on providing our clients with the most beneficial machinery loan. Get a loan against the machine at ease.

Private Debt Fund specifically addresses the substantial gap in regional financing markets to deal with the industry challenges in the best way possible. The private debt players follow all the rules and guidelines laid down by the RBI and the Govt of India.

Project report funding allows better management of cash flow. We at Terkar Capital understand the whole project business cash inflow, monitoring the cash-out flow. Get a detailed and full-fledged project report for funding and obtain an assured loan for your project.

In structured debt, many financial instruments are combined, and if necessary, syndication is required as well. This is 100% tailor-made – meant exclusively for company solutions. To facilitate the growth of company, Terkar Capital works with respective finance institutions and clients

Loan for Professionals is a credit product designed for professionals. The professionals generally include – CAs, ICWA, CS, Doctors, and Architects. The purpose of professional loans is to provide credit to individuals who are working professionals in the business world.

Unlock your business potential with LAS (Loan Against Shares / Securities). With LAS, you can leverage your bonds, shares, and mutual funds as security to secure debt funding. Empower your business with the right financial backing today.

We arrange private equity instruments across India. Whether you’re venturing into private equity, venture capital, or private equity funds, we understand the challenges and the need for substantial funding.

Project funding unlocks the potential of new projects and propels businesses forward. Financial constraints can impede planned schedules, but project funding can help.

We at Terkar Capital, assist you by arranging Financial Instruments. The team simplifies the process of fundraising & Executes the operations quickly. So you don’t have to worry about complicated steps as you advance forward with your decisions. We offer financial tools that are tailored specifically for businesses right here in India, so don’t hesitate because of geography – get everything you need now.

Learn more about investment banking instruments here.

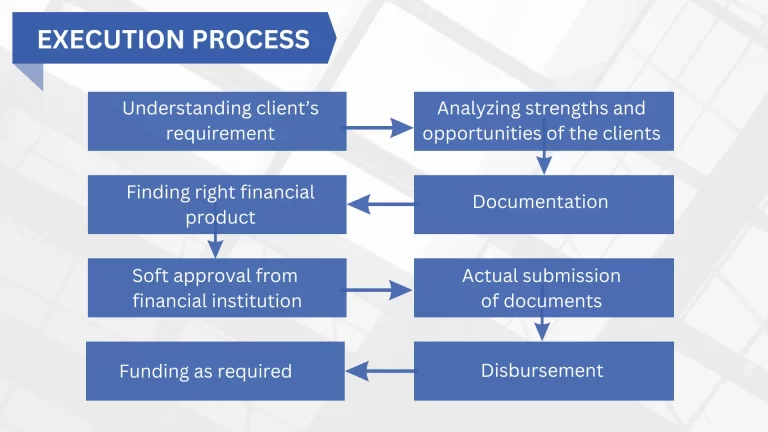

At Terkar Capital, we have a well-defined process for businesses to access the appropriate financial instruments tailored to their specific situations smoothly:

We cordially track the deadlines and make our quality tangible, while executing finance projects well ahead of time.

We comply with the highest professional confidentiality standards. All client information is discussed in strict confidentiality.

We find you the right lenders with similar terms and the lowest rate of interest.

We create a stable ownership structure for financiers by establishing a secure transaction process.

We are building our reputation through reliability, integrity, and honesty. We connect to our clients on personal grounds that include transparency and liability.

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024