Introduction to Precision Machine Loans

Precision machine loans are a type of machine loan with specialized financial solutions designed to support businesses in acquiring advanced machinery and equipment. These loans are tailored for industries like manufacturing, pharmaceuticals, aerospace, defence and engineering that require the latest machines to enhance productivity, accuracy, and operational efficiency. However, acquiring precision machines often requires significant financial infusion, which can be challenging for many businesses.

Why Precision Machines Are Vital for Industry Growth?

Precision machines are essential for businesses to maintain quality, meet industry standards, and stay competitive. However, the high cost of these machines can be a barrier to growth. As a result, funding options for precision machinery are crucial to overcoming this obstacle and providing the necessary liquidity for businesses to fund these critical assets.

Furthermore, industries such as aerospace, pharmaceuticals, defence, automobiles and manufacturing require constant upgrades to comply with regulations and maintain efficiency. While the upfront cost is high, precision machines offer significant returns through increased efficiency and operational cost savings. Therefore, financing spreads this cost over time, making it more manageable and enhancing overall profitability.

Interested in a precision machine loan? Let’s connect.

Types of Precision Machine Loans

At Terkar Capital, we cater to diverse industries by providing financing for various types of precision machinery. Here are the key categories:

- CNC Machines: Computer Numerical Control (CNC) machines, essential for modern manufacturing, are driven by high-tech computers.

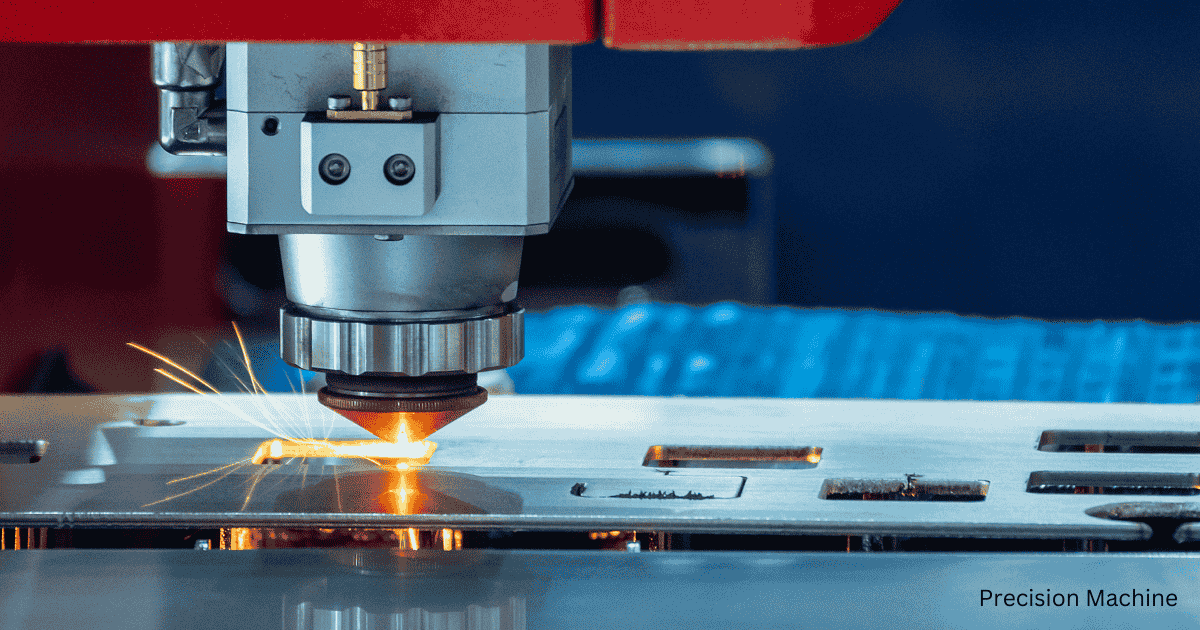

- Laser Cutting Machines: Industries that require precise designs and accurate cuts use precision machines.

- Pharmaceutical Equipment: Machinery designed for the manufacturing of medical devices, diagnostics, and pharmaceuticals

- Robotic Systems: Production lines optimized with advanced automation tools

- 3D Printers: Precision manufacturing and prototyping with emerging technologies.

- Injection Molding Machines: Essential for plastic manufacturing, these machines produce components for industries such as consumer goods, automotive, and medical devices.

- Grinding and Milling Machines: These are key for machining components with ultra-fine precision and are widely used in toolmaking and industrial manufacturing.

- Food Processing Equipment: Machinery for precision slicing, dicing, and packaging used in the food and beverage industry.

Advantages of Precision Machine Loans

Choosing Terkar Capital for your precision machine financing offers several benefits:

- Avoid depleting working capital by spreading machinery costs over time.

- Interest on loans is tax deductible as a business expense.

- Using advanced equipment, you can scale operations and take on larger projects.

- Precision machines improve efficiency and quality, resulting in faster ROI.

- Improved quality can lead to greater customer satisfaction and repeat business.

- Flexible financing options can be tailored to your specific needs and budget.

Conclusion

Precision machine loans are essential for businesses aiming to acquire advanced technology without depleting their financial resources. At Terkar Capital, we recognize the distinct financing requirements of industries that rely on precision machinery. Consequently, our Precision Machine Loan solutions are specifically designed to enable businesses to procure the latest equipment without impacting their working capital.

Moreover, we merge industry expertise with innovative financial solutions to empower businesses in the pharmaceutical, manufacturing, aerospace, and other precision-driven sectors. Whether your goal is to upgrade existing machinery or invest in new technology, our Precision Machine Loans are designed to facilitate your objectives. Let’s explore.

Find out more about Precision engineering here