- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

An IT company wanted funds to expand globally while reducing currency risks. Terkar Capital helped them through the foreign currency term loan process, securing a loan with lower interest rates and flexible repayment. This allowed the company to grow internationally without financial strain. This case study shows how businesses can use foreign currency loans to expand smoothly.

To understand how a foreign currency term loan process works, We consider David’s case.

David owns a food import-export business called ‘Fresh Foods Private Limited. His company exports various food products to different countries in the world. That includes the US, Europe, Canada, and so on. David started his business in the year 2014 and his business has grown rapidly since then. Thus, the turnover of ‘Fresh Foods’ this year is Rs. 50 crores.

David has recently received an overture from a multinational corporation for a substantial order, constituting approximately 10% of his overall sales. Recognizing the significance of this opportunity, David is keen on ensuring a flawless execution. Upon meticulous examination of pertinent variables, he discerns that the specialized nature of the exported products necessitates a distinct packaging material. Given the substantial volume of the order, procuring this packaging material in bulk results in a significantly lower per-unit cost. Consequently, the requisite funding to validate and fulfil this order is estimated to be in the vicinity of INR 11 crores.

Thus, David is thinking of taking funding from a financial institution. If he takes the funding in rupees, which is very traditional, he has to deal with the Indian inflation rate and high cost of capital. This time while raising the funds, he is very sure. So, he wants to arrange for the cheapest cost of capital. But David is still confused if any such facility is available for him in the market.

So, while searching for the Foreign Currency Term Loan Process and services, he came across Terkar Capital. He approached one of our representatives and we set up a meeting with him on the foreign currency funding process.

| Company Turnover | Rs. 50 Crores |

| Amount Required | Rs. 11 Crores |

| Mortgage Availability | Residential Property and Commercial Property |

| Company Industry | Food Import-Export Industry |

David spoke to us about his situation, requirements, and expectations. We analyze his business scenarios, balance sheet, geographical operations, financial requirements, and the funding options available. And thus we suggested that the option of foreign currency loans is the best option for him.

Financial Institutions provide foreign currency financing. In this, one can borrow the amount of the loan in a foreign currency and repay the loan in that foreign currency too. For David, a foreign currency term loan is, therefore, a perfect fit. In foreign currency financing, the rate of interest charged by the financial institutions is lower compared to the loans taken in Rupees. The banks may charge a rate of LIBOR + 1–2%. While in other traditional loans, the rate of interest will be around MCLR+1%. Comparatively, foreign currency funding is cheaper.

International financing was very convenient for David. He received the foreign exchange funds around 6 days after he approached us. After he received the payment from the foreign client he started the repayment of foreign currency loans. David was very happy with Terkar Capital’s foreign currency funding process. So, whenever he requires any financial advisory or consulting services, he just drops a message to Terkar Capital and we get the work done!! Thus, we are the preferred debt partner for Fresh Foods Private Limited.

| Business Commencement Year | 2014 |

| Amount of Funding | Rs.11 Crores |

| Total Execution Time | 6 Working Days. |

| Best Rate of Interest In the Indian Market | 9.1% |

| Rate of Interest we offered | LIBOR + 1.5% |

| Customer Service Experience | 4.4/5 |

Terkar Capital understands the needs of MSMEs like David’s food import-export business. When David received a big order from a multinational company, he sought funding to meet the requirements. Thus, we offered him a foreign currency loan, which proved to be the best option due to its lower interest rate compared to rupee loans.

With our assistance, David received the funds promptly, enabling him to fulfil the order and start repaying the loan once he received payment from the client. Terkar Capital’s efficient foreign currency funding process made David a satisfied customer and our go-to debt partner for future financial needs.

Apply for foreign currency funding – Book a call today!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

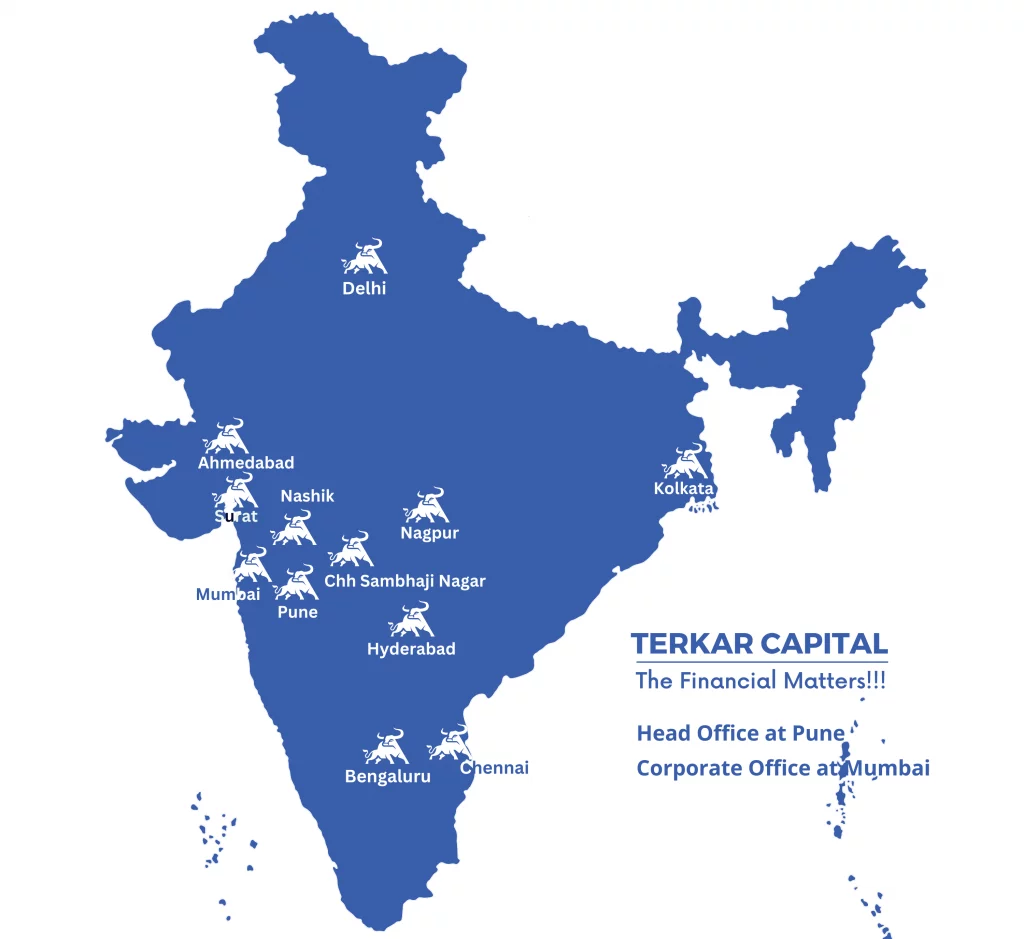

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…