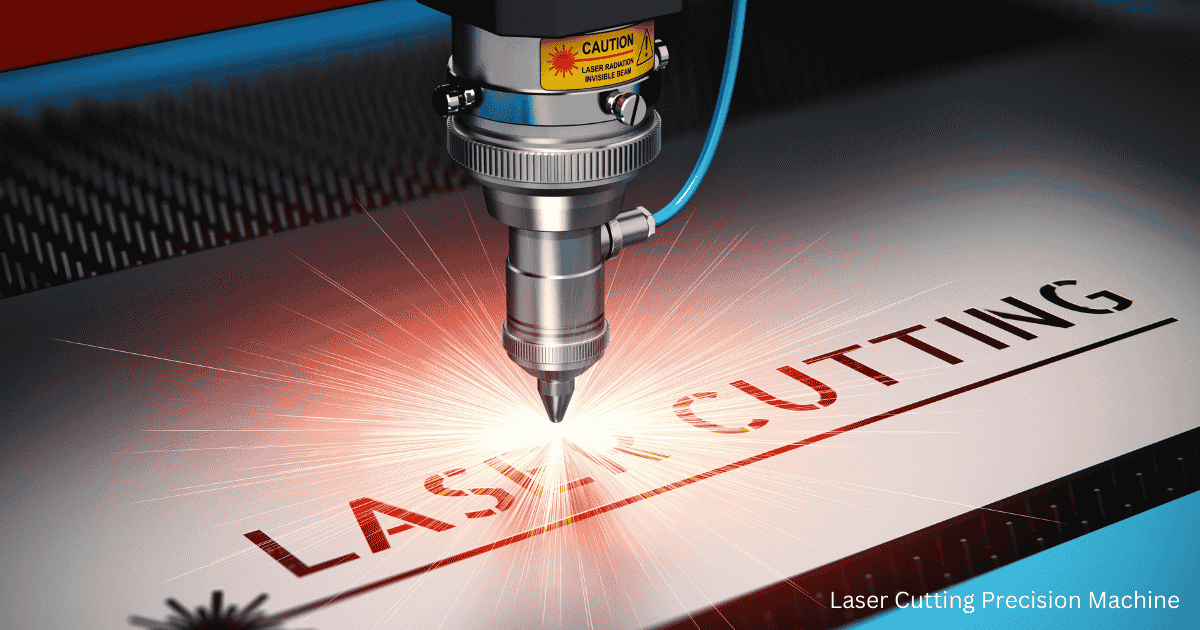

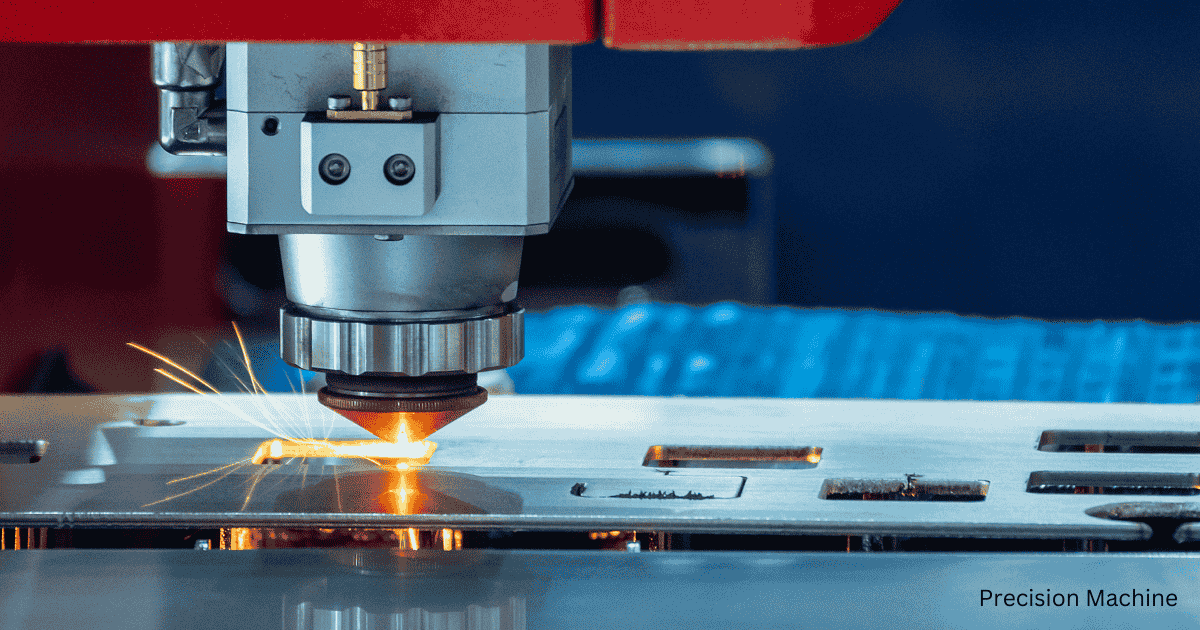

Introduction to Laser Cutting Precision Machine Loans Laser-cutting technology is essential for industries that need precise and accurate cutting. Manufacturing, automotive, aerospace, and jewelry businesses all rely on laser cutting machines for high-quality and efficient results. However, these machines require a significant financial infusion. Many companies are now opting for Laser Cutting Precision Machine Loans instead of outright purchases. These loans provide the necessary capital for acquiring the machinery while spreading the cost over time, making it a more manageable financial commitment for businesses. This approach allows companies to benefit from laser-cutting technology without the immediate burden of high upfront costs, making it a viable option for businesses of all sizes. Why Are Laser Cutting Precision Machine Loans Essential? Financing a laser cutting precision machine is a strategic move for businesses looking to enhance productivity, precision, and cost efficiency. Businesses need funding to buy advanced laser cutting machines, which can affect their cash flow. Getting a loan lets them spread these costs out over time. Keeping up with the competition means regularly updating our machines to meet industry standards and customer needs. Precision cutting is great because it reduces material waste, speeds up production, and makes the final product even better. Having the right equipment allows businesses to increase what they can produce and take on tougher projects. Interested in a Laser cutting precision machine loans? Let’s connect. Book Now How Laser Cutting Precision Machine Loans Work? 1. Financial SWOT analysis We’ll review your finances, business needs, ability to repay and capitalise on strengths. 2. Customized Loan Structuring We offer flexible repayment options, competitive interest rates, and tailored loan amounts to fit your specific needs. 3. Quick Loan Processing We keep the paperwork light for a quicker loan approval process. 4. Expert Consultation Our financial experts will work with you to find the best financing solution for your business. Types of Laser Cutting Precision Machines We Finance We offer loans for a wide range of laser cutting machines, including: CO₂ Laser Cutting Machines: Ideal for non-metal materials like acrylic, wood, leather, and textiles. Fiber Laser Cutting Machines: High-efficiency machines designed for precision cutting of metals such as steel, aluminum, and copper. YAG Laser Cutting Machines: Used for high-precision cutting in the automotive and electronics industries. Plasma Laser Cutting Machines: These are Suitable for thick metal cutting in heavy industries. Ultraviolet (UV) Laser Cutting Machines: Ideal for micro-cutting applications in the electronics and medical device industries. Advantages of Laser Cutting Precision Machine Loans Choosing Terkar Capital as your financing needs offers several key benefits: Tailored to fit your business’s unique cash flow and growth needs. Select from structured EMIs or balloon repayment options to suit your financial situation. Designed to be affordable and easy on your finances. Minimal paperwork and fast loan approval to get you the funds you need quickly. Our financial experts will help you find the best financing plan for your business. Conclusion In conclusion, Terkar Capital’s Laser Cutting Precision Machine Loans offer a strategic financial solution for businesses aiming to enhance their operational capabilities. By providing access to advanced laser cutting technology without the burden of upfront costs, these loans empower businesses to optimize their production processes, improve product quality, and maintain a competitive edge in the market. Find out more about laser cutting here.

Office Hours - Mon to Sat - 9:00 to 19:00 Hrs