- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

Large-scale projects require large amounts of funding, but securing it can be complex. Project finance helps by structuring loans based on the project’s future cash flows, which reduces financial stress. In Alex’s case, his renewable energy venture required a large amount of capital. Through project finance, he secured funds with flexible repayments tied to revenue generation, ensuring a smooth implementation. Let’s explore a project finance case study with a solution to better understand this.

Robert owns an automotive manufacturing company known as ‘RD Manufacturing Private Limited’. He started the company 10 years ago. The company is doing very well with a turnover of 75 crores this year. The company is into manufacturing automobile parts and other essential components. Some of the best automotive brands in India are clients of ‘RD manufacturing’.

Till now, Robert’s company had an office in Mumbai and a manufacturing plant in Pune. Now, due to the rapid growth of the business, Robert’s clients have spoken to him about opening another plant in Jamshedpur. Therefore, now Robert is looking forward to expanding his business by opening another manufacturing unit at Jamshedpur. But he is worried about the funds for his new project. Taking the funds out of working capital will create a challenge for the existing customer and will hamper the working capital cycle.

As a good businessman, this is not a good course of action. So he started to explore the options of raising the funds from the debt market, without disturbing the existing fund flow. He has good credit and can repay the loan from the revenue he gets from his project finance case study after completion. He foresees very good profit and rapid growth if he expands his company now. Thus, Robert’s rating as a business person and his extensive experience in the manufacturing industry is well known.

Read more about effective management of the working capital cycle here.

| Company Turnover | Rs. 75 Crores |

| Amount Of Funding Required | Rs. 20 Crores |

| Mortgage Availability | The project itself is a mortgage |

| Company Industry | Automobile Manufacturing |

Robert is especially looking for Non-recourse funding as a feature of the loan. Non-recourse funding means that he and the other shareholders of the borrower will have no personal liability in case of monetary default. Any recourse the lender may have will be limited primarily or entirely to the project assets if the project company defaults on the debt.

He didn’t know which loan to apply for or which financial institution to contact. While discussing his problem with a business friend, the name Terkar Capital came across. Thus, Robert approached Terkar Capital and we set up a meeting with him to understand the process of project financing.

| Business Commencement Year | 2010 |

| Amount Disbursed | Rs. 20 Crores |

| Moratorium Period | 13 Months (From 1st Disbursement) |

| Total Execution Time | 20 Working Days. |

| Customer Service Experience | 4.4/5 |

Our executives met Robert and understood his requirements for the funding and his business. So, after a detailed discussion, we suggested that he should take Project Finance. This type of funding would be a perfect fit for him considering the viability of his project, payback period, and his personal experience and profile.

The financial institution has to show that the project finance case study is viable to receive the loan. Therefore, we helped Robert prepare a report explaining his project and the financial position of the company. And that he is capable of paying off the loan from the revenue, that project generates. He also would not require any separate mortgage for the funding as the project itself will act as a mortgage for the loan. In the case of project funding, the funds can be generated as per the requirement, be it periodically or all at the same time.

Robert got his project funding sanctioned in just 20 working days after approaching us. Robert’s new manufacturing plant has been doing very well now and he has almost repaid the entire loan amount. So, now, he is one of our loyal customers at Terkar Capital.

Terkar Capital understands the needs of entrepreneurs like Robert, who are seeking project funding services. With a personalized and human approach, our executives took the time to listen to Robert’s requirements and thoroughly assessed his business.

Recognizing the potential for growth and Robert’s credibility, we recommended Project Finance as the ideal solution. This allowed Robert to secure the necessary funds without disrupting his existing operations. Today, Robert’s manufacturing plant thrives, and he stands as a testament to our commitment to our loyal customers at Terkar Capital.

Get Project Financing at Ease – Book a call today!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

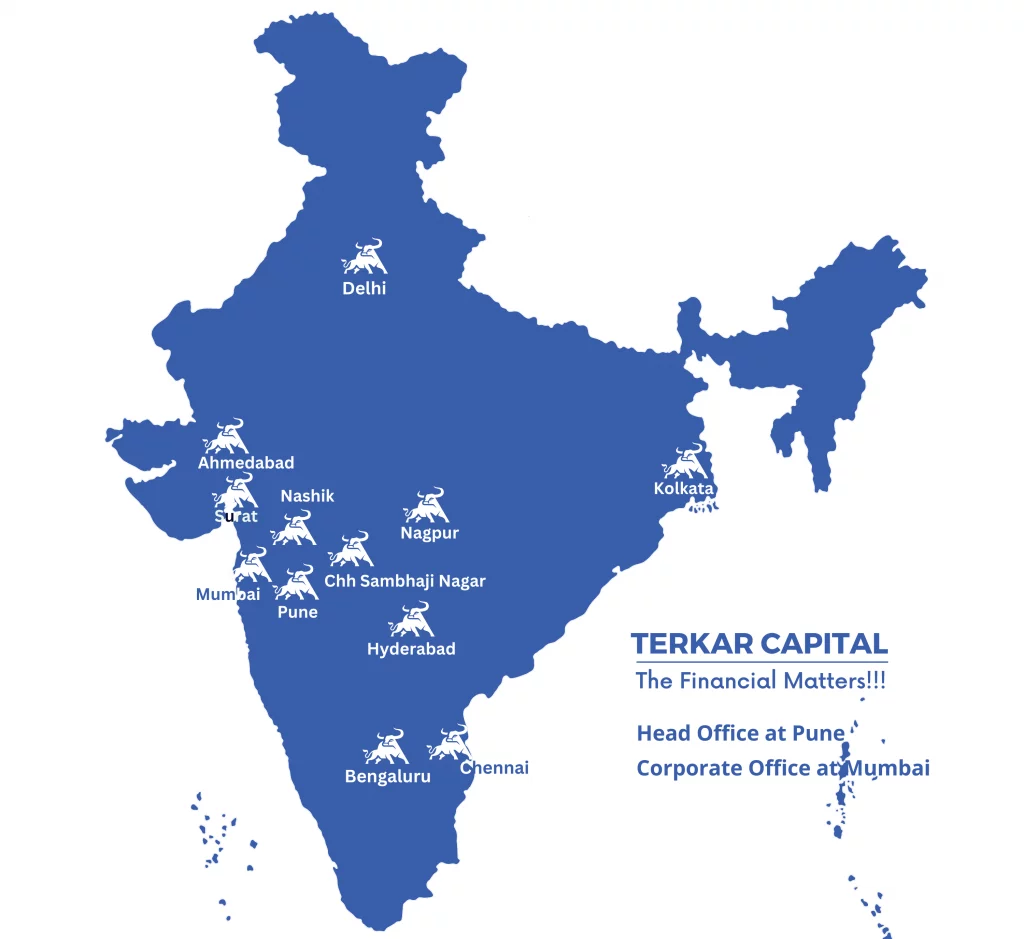

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…