- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

We understand that acquiring new machinery is crucial for business growth. This case study examines how a machinery term loan can help businesses invest in essential equipment. We’ll explore the benefits of a loan for machinery purchase, focusing on flexible repayment options and competitive interest rates designed to make acquiring new machinery easier.

David, the owner of Perfect Plastics Private Limited, has been in the plastic manufacturing industry since 2015. Last year, David’s company achieved a turnover of 37 crores. With rapid growth over the past few years, Perfect Plastics has caught the attention of a large multinational company, which is proposing a significant deal. If this deal goes through, it promises to bring major profits to David’s business.

To date, David has reinvested all earnings back into the business. However, the multinational company requires David to purchase advanced machinery to boost productivity and quality. This new machinery is crucial as it will significantly enhance Perfect Plastics’ output quality, reduce costs, save time and energy, and ultimately generate more profit.

Understanding the importance of this investment, you might be wondering about the machinery loan process to finance this acquisition. Terkar Capital specializes in facilitating machinery loans, making it easier for businesses like Perfect Plastics to obtain the necessary equipment finance. By securing a machinery loan through Terkar Capital, David ensured his plant is equipped with the latest machinery, positioning his company for even greater success.

| Company Turnover | Rs. 37 Cr. |

| Amount Required for Machinery | Rs. 7.5 Cr. |

| Mortgage Availability | No Mortgage |

| Company Industry | Plastic Manufacturing |

This is an expensive German Machine. David is thinking about how he can fund the machinery. The machinery costs 7.5 crores (Including GST and installation). If he doesn’t purchase the machine, the deal may not go through as a bigger company is already trying to get the deal.

David’s company has a good CIBIL rating as they have a good credit history. The company also has a steady and genuine cash flow which can be reflected in the company accounts. However, unfortunately, David does not have any assets or property that he can keep as collateral with the financial institution. Thus, he realizes that he would require a business loan without collateral. The purchase is for at least 5 years at a moderate interest rate. He has good cash flow, but he cannot pull the money from the existing cash flow as this will directly affect the existing working capital and the customer’s delivery.

David was anxious about obtaining an unsecured loan to purchase machinery. While looking for financial consulting firms, he came across Terkar Capital. He contacted Terkar Capital and we scheduled a meeting with him.

| Business Commencement Year | 2015 |

| Amount Disbursed For Machine | Rs. 7.5 Cr. |

| Total Execution Time | 7 Working Days. |

| Customer Service Experience | 4.3/5 |

Our executives understood David’s requirements. We analyzed the case in detail. After the analysis, we recommended him for a financing Machinery, Instead of going for any other unsecured term loan.

A collateral-free machinery loan is a term loan for machinery. It is taken for purchasing machinery. It enables small and medium-scale enterprises to afford tools and other equipment for their use. The better is your machinery, the better the productivity. Hence the efficiency of a company.

We understand the requirements. Once receive all the required inputs from the company, we prepare a proposal for equipment finance. That contains information about the company. The machinery they plan on purchasing, the amount of funding required, and others. This machine is being made in Germany so we had to make the payment to Germany. We took note of all the required inputs to execute the proposal. The machinery finance providers sanctioned within 3 days upon receipt of all the documents!!

David, thus, got a business loan for machinery 7 days after he approached us. Now he has almost completed 10 EMIs. Thus, the bottom line and the top line of the company both are in strong positions. Since then, we have been preferred as a debt financing partner for Mr David and his company. So whenever Perfect Plastics Private Limited requires debt funding, they just give us a call, and the rest is taken care of by our experts.

Need Financing for Business Machinery? Book A Call Now!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

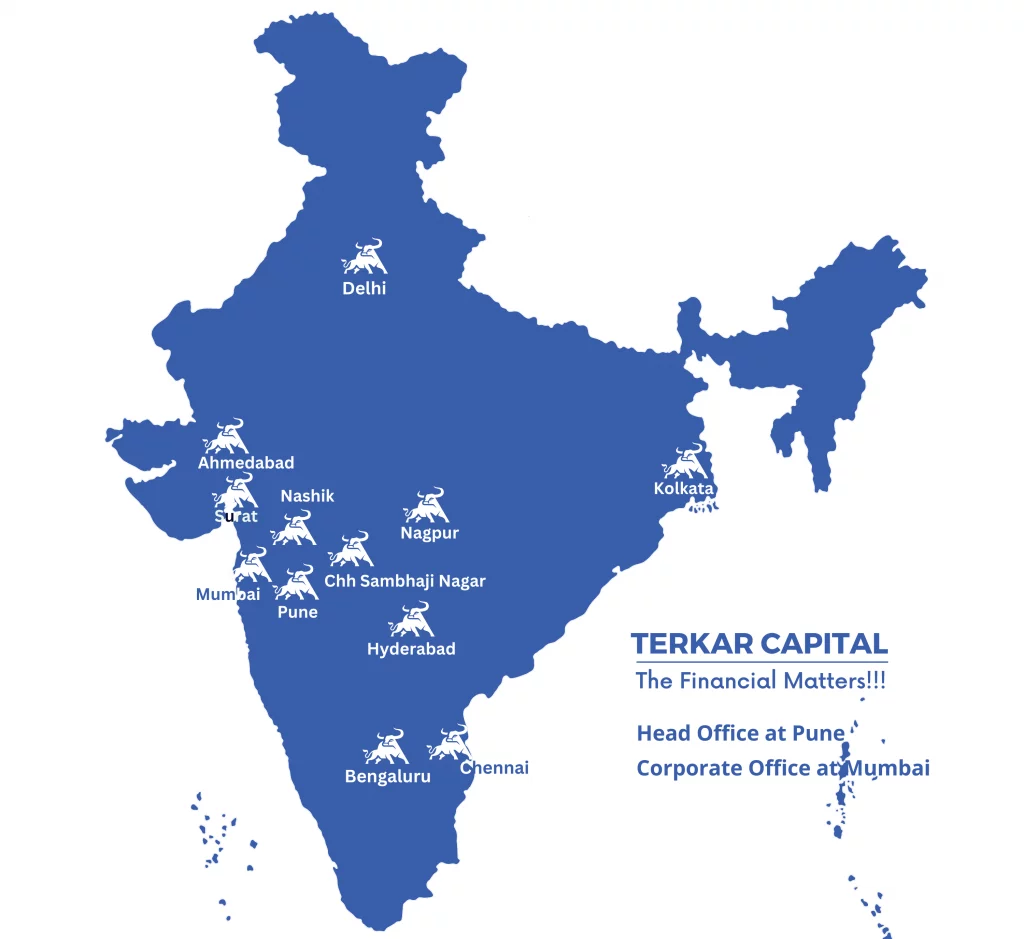

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…