- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

Lease Rental Discounting (LRD) helps property owners get a loan against future rental income. Mr Rajan needed funds for business expansion and used LRD to unlock capital without selling his property. Let’s understand the LRD process and the Lease Rental Discounting Process through the Mr. Rajan case study.

Mr Jacod has been a proprietary firm for the last 20 years. Jacob recently gave his premises on lease for 5 years to the vast and renowned cotton clothing brand. His turnover for the previous year is Rs. 1.4 Cr. As his business is growing, the resources of proprietary concern stand short for him and needs funds for expansion. He decides to convert his proprietary concern into a Private company that will make huge profits. Jacob thinks from which sources the funds will be managed. Having no collateral, it was difficult for him to get funding.

Jacob had all the ideas ready for expanding the business but what hampered him was his issue with funds. He consulted many people and the financial institution but to no avail! Everyone was asking for collateral for loans. While going through the Internet, he came across Terkar Capital. And visited our website. He soon contacted our team and the meeting was immediately fixed.

Jacob was worried about his problems with funds and started telling us his requirements. Our team understood his needs, and we asked him about the financials. After analyzing all the documents and areas of his business, we realized a strong point that Jacob owns premises that he has given on lease for 5 years. Our team studied the areas related to property and concluded that Mr Jacob can go for Lease Rental Discounting.

We suggested Jacob, to proceed with LRD loan, which is one of the convenient sources of funding. Also, the tenant or a lessee was a renowned brand in clothing.

LRD is a term loan that is provided to the borrower based on their income from the rented property. A major aspect that affects the LRD loan process is the availability of rent receipts from the tenants. The tenant or the lessee here should be a renowned brand or corporate, etc.

Furthermore, we undertook the valuation of the property and rental receipts and concluded that Lease Rental Discounting would best suit the client according to his financials. The funding went to the lending institution for sanction, and soon the funds were released to the borrower. The process was carried out smoothly by our team members and the funds were received by Jacob, which solved his issue for expansion. The ROI given was also reasonable. Jacob was delighted by our service and started his successful journey.

Learn in detail about what is an LRD Loan here.

| Nature of Business | Proprietary concern |

| Turnover of last year | Rs. 1.4 Cr |

| Mortgage Available | Rented/Lease property |

| Valuation of Property(Market Value) | Rs. 12 Crores |

| Rental Receipts of 5 years (Lease Receipts) | Rs. 60,00,000 |

| Need for funds | Business Expansion |

Terkar Capital, a trusted financial institution, facilitate LRD funding like Mr Jacob, who faced challenges in securing funds for business expansion. Despite his lack of collateral, Jacob approached us and shared his requirements. After carefully assessing his financials and business prospects, we identified that he could benefit from Lease Rental Discounting (LRD). With his property leased to a renowned clothing brand, we determined LRD as a convenient financial instrument.

We conducted property valuation and assessed rental receipts, leading to a smooth funding process. Jacob was pleased with our service and embarked on his successful journey.

Take Advantage of Lease Rental Discounting – Book a Call Today!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

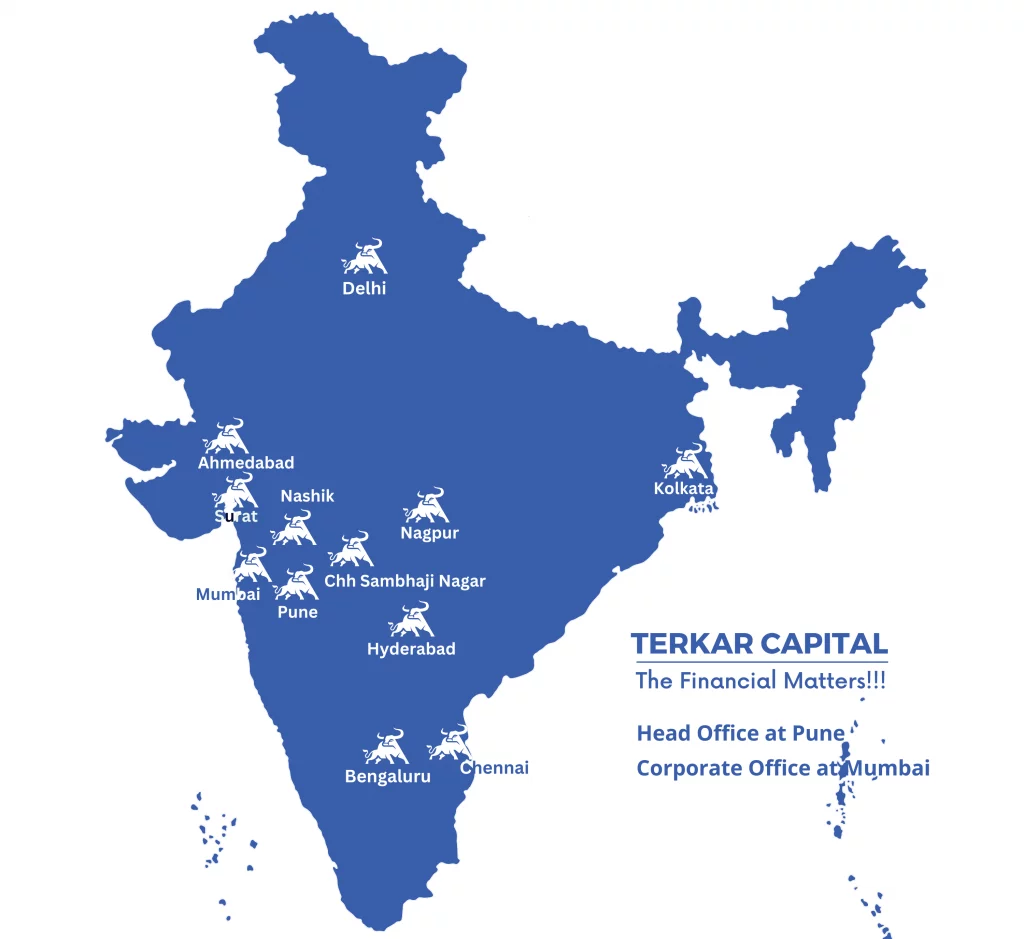

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…