- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

A Letter of Credit (LC) helps businesses secure transactions by guaranteeing payments. However, waiting for funds can impact cash flow. This is where LC discounting comes in. Allowing businesses to get immediate funds against their LC before maturity. In Mr Karl’s case, his company needed urgent working capital to fulfil new orders. He accessed funds instantly by opting for LC discounting, ensuring smooth operations without financial strain. Let’s understand the LC discounting process in detail through Mr. Karl’s case study.

Mr Karl owns the manufacturing unit in South Korea. Produces good quality aluminium strips. These aluminium strips are used in many industries including pharma, automotive, electronics, etc. And having worldwide demand. The company was incorporated 5 years ago and multiplied the business every year. The current year turnover of the company is around $ 56 million. Mr Karl got an order of $7 million from a mid-sized Indian company. This Indian company has also recently started doing wonderful business. However, not have a long track record in the business. Mr Kamat owns this Indian company. Mr Kamat wants to purchase these aluminium strips and Mr Karl also wants to sell these.

However, Mr Kamat is not sure, if the payment is made Mr Karl will deliver the goods or not. And Mr Karl is not sure if the goods are delivered or manufactured, or whether Mr Kamat will make the payment or not. Both of them are very genuine business companies. Hence, they decided to effect the transaction backed by the LC discounting. So this can give the comfort of the transaction to both Mr Karl and Mr Kamat.

Sr. No | Particular I | Particular II |

1 | Buyer | Mr. Kamat |

2 | Buyer Country | India |

3 | Seller | Mr. Karl |

4 | Seller Country | South Korea |

5 | Product to be ordered | Aluminum Strips |

6 | Order Size | $ 7 Million |

7 | Credit Period | 30 days from shipment |

8 | Transaction currency | USD |

This was the first time Mr. Kamat was entering into an international transaction and he had no idea how the whole LC transaction would take place. He discussed the same issue with one of his business friends and his friend suggested that he should approach Terkar Capital. When Mr Kamat approached Terkar Capital, our expert team understood the whole transaction and arranged the issuance of the LC within 24 working hours. We arranged the discounting of LC from SBI.

The issuance of the LC was so fast that Mr Kamat was able to place and confirm the order in 2–3 working days. Considering the swift confirmation of the order and LC issuance, Mr Karl was also impressed with Mr Kamat’s commitment to the order and decided to prioritize the order. In the next 25 days, Mr Kamat received the order from Mr Karl. Because of the smooth execution of the LC discounting process, Mr Kamat has always trusted the valuable advice of Terkar Capital.

So, whenever Mr. Kamat requires any assistance for the Lc issuance, he approaches us and our experts conclude it to be the best.

Apply for LC Discounting Facility – Book a call today!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

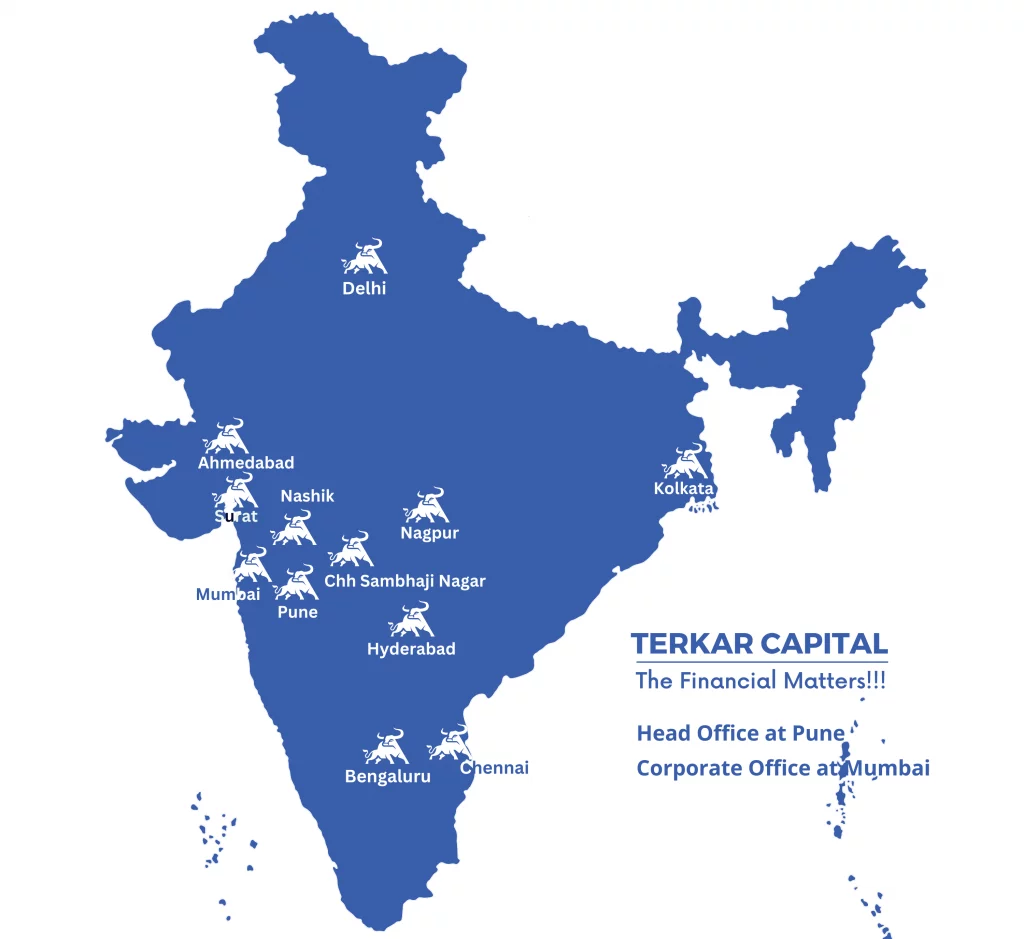

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…