- Office Hours - Mon to Sat - 9:00 to 19:00 Hrs

- Yes@terkarcapital.com

- +91 7414973455

John is starting to manufacture a new line of products in two months. While he is planning for the new manufacturing line, he realizes the issue of working capital that he may face. John will raise the invoice and his customer will pay it after a certain period at the decided due date, it takes 30 to 90 days to get the invoice paid by the client. John’s payment thus gets stuck and his working capital will be blocked till he gets his payment.

This new manufacturing line is for a big company. Thus the working capital cycle is long and John’s cash flow doesn’t allow for the desired credit period. So, John is thinking about taking funding from a financial institution. But he realizes he has no asset or property which he can keep as a mortgage. Also, paying interest on the entire amount of the loan doesn’t seem convenient to him. Thus, he will be using the money until his customer repays him.

John is very worried. While searching for financial advisory firms online, he came across Terkar Capital. He approached Terkar Capital. And set up a meeting with him to explain the bill discounting facility for manufacturing.

| Company Turnover | Rs. 7.5 Crores |

| Amount Required | Rs. 1.3 Crores as working capital |

| Mortgage Availability | No Mortgage |

| Company Industry | Manufacturing Industry |

We discussed his business situation and its requirements. After the financial SWOT of the same, we suggested Bill Discounting Facility for his business situation. This was a perfect fit. Bill discounting, an unsecured business loan, was thoroughly explained to him before proceeding with the execution.

Let’s understand what is a bill discounting thoroughly.

We then approached a financial institution for a bill discounting facility. John had good creditworthiness and the financial institution was convinced of the legitimacy of the bill. The respective financial institutions discounted the bill and the margin was decided as per the agreed terms. As per invoice financing, the financial institution has given the required exposure of Rs. 1.3 crores, which John can use as and when he raises an invoice to his customers.

We arranged the funding almost in CC format. Thus, the bill discounting limit was open for John. He could use the limit as and when an invoice was raised to the client. John could use the money immediately for working capital. Due to the bill discounting facility, he did not have to wait for 50 or 90 days until the customer paid him the invoice amount. The whole process of discounting bills of exchanges is carried out in 5 working days. Thus, Mr. John was super happy with our service and professional execution of the proposal.

| Business Commencement Year | 2010 |

| Amount of Funding | Rs. 1.3 crores |

| Total Execution Time | 5 Working Days. |

| Customer Service Experience | 4.5/5 |

Terkar Capital provides a comprehensive explanation of the funding process to the client, including the different types of bill discounting, to ensure that both parties have a clear understanding. Terkar Capital has strong ties to many lending parties in the market. We are a well-respected financial consulting and advisory firm. If you are seeking financial assistance, we are here to help.

Apply for Bill Discounting Facility – Book a Call today!

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

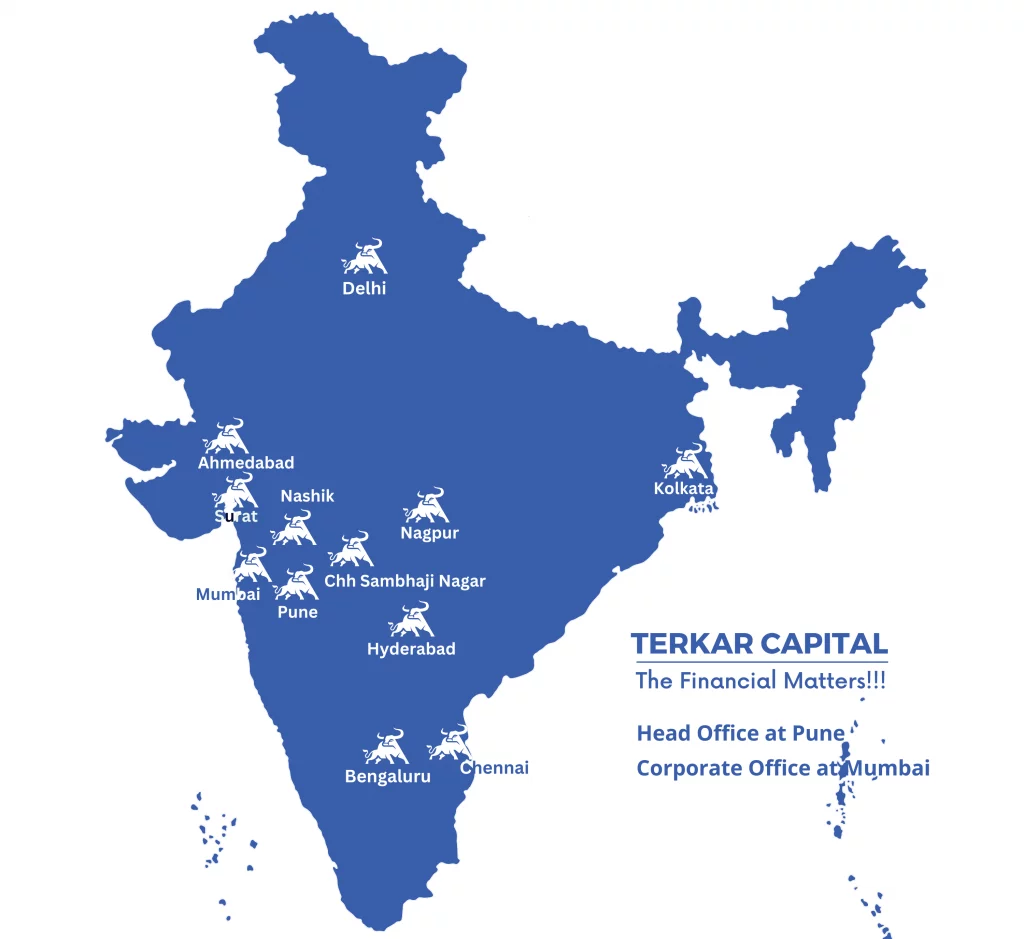

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…