1. Understanding Client's Requirement

A tailored funding solution based on a thorough evaluation of the client’s business goals and financial requirements.

Unsecured debt products offer quick access to capital without the need for collateral, making them a preferred financing solution for businesses across India. Whether it’s managing machinery expenses, paying workers, clearing pending bills, or purchasing new inventory, these loans provide the flexibility to address short-term financial needs.

At Terkar Capital, we understand the challenges businesses face, especially MSMEs with limited financial resources. Our unsecured debt products are tailored to provide the necessary financial support, ensuring smooth operations and uninterrupted growth. Apply now to secure hassle-free funding and empower your business.

Funding amounts from Rs 25 Lacs to Rs 15 Cr

Fast Turnaround time (as low as 3-4 days)

Professional Execution

Smooth Processing

Simple terms and less paperwork

(*T&C Applied)

The eligibility criteria for obtaining unsecured debt products are typically standardized across most financial lending institutions. These criteria are often influenced by the lending firms’ practices and industry norms.

This collateral-free loan is perfect for entrepreneurs looking for financial flexibility and ease, as it can help you address immediate challenges such as machinery acquisition, employee remuneration, outstanding invoices, and inventory restocking.

As a business leader, you are aware of the importance of working capital for consistent growth and meeting market needs. Whether in manufacturing, services, or trading, adequate working capital is essential for success in the competitive modern environment.

The government-backed program aims to promote the growth of SMEs by both strengthening existing businesses and empowering new ventures. The CGTMSE scheme has significantly transformed the manufacturing sector and revitalized the Indian economy.

Expand your business globally while addressing issues such as working capital, payment security, and credit terms. Our solutions include trade financing and expert financial risk management, ensuring a seamless international trade experience.

Bill discounting can help you get quick working capital to expand your business. You can submit your invoices to financial institutions with minimal paperwork, which will ensure quick payment. This will help you improve your cash flow and propel your company’s progress.

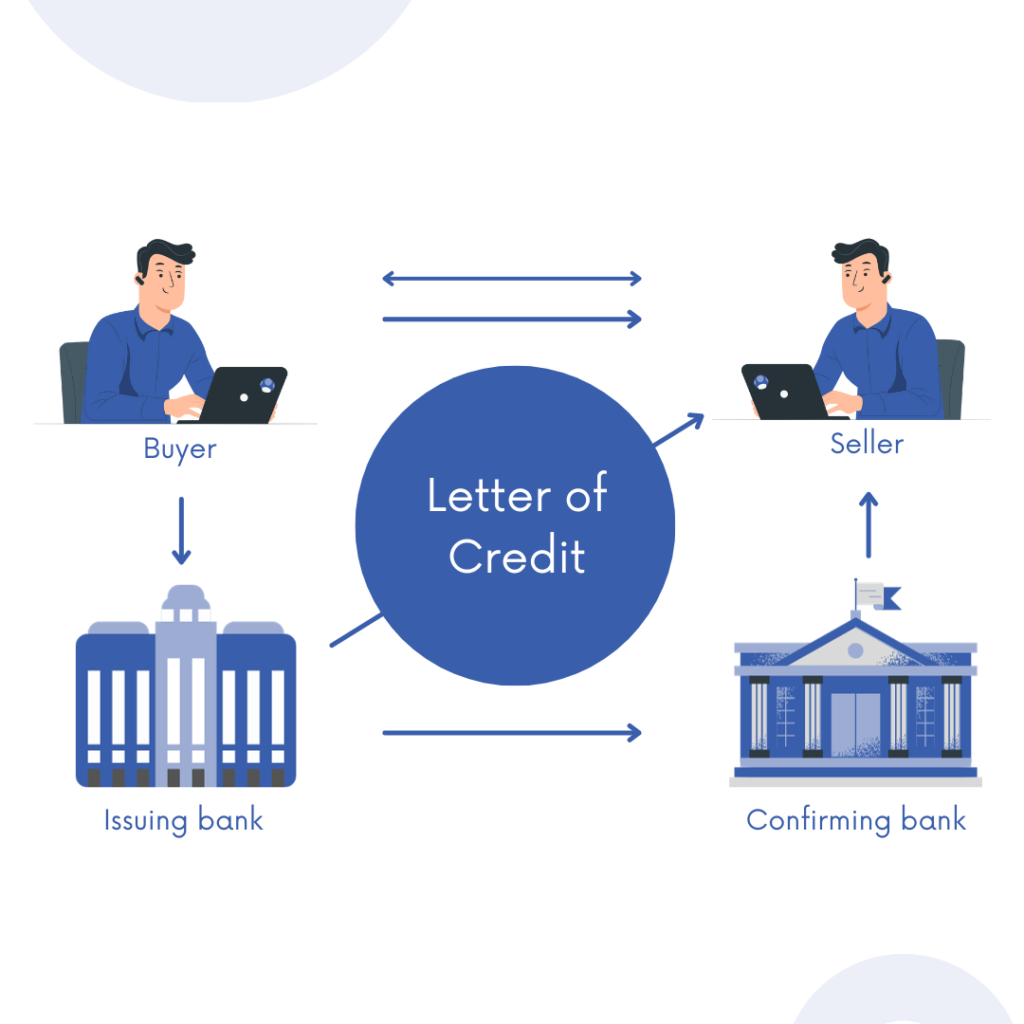

Experience the convenience of Letter of Credit Discounting, an innovative credit solution tailored to meet your business’s working capital needs. With your reliable banking partner, take advantage of the flexibility and simplicity of LC Discounting.

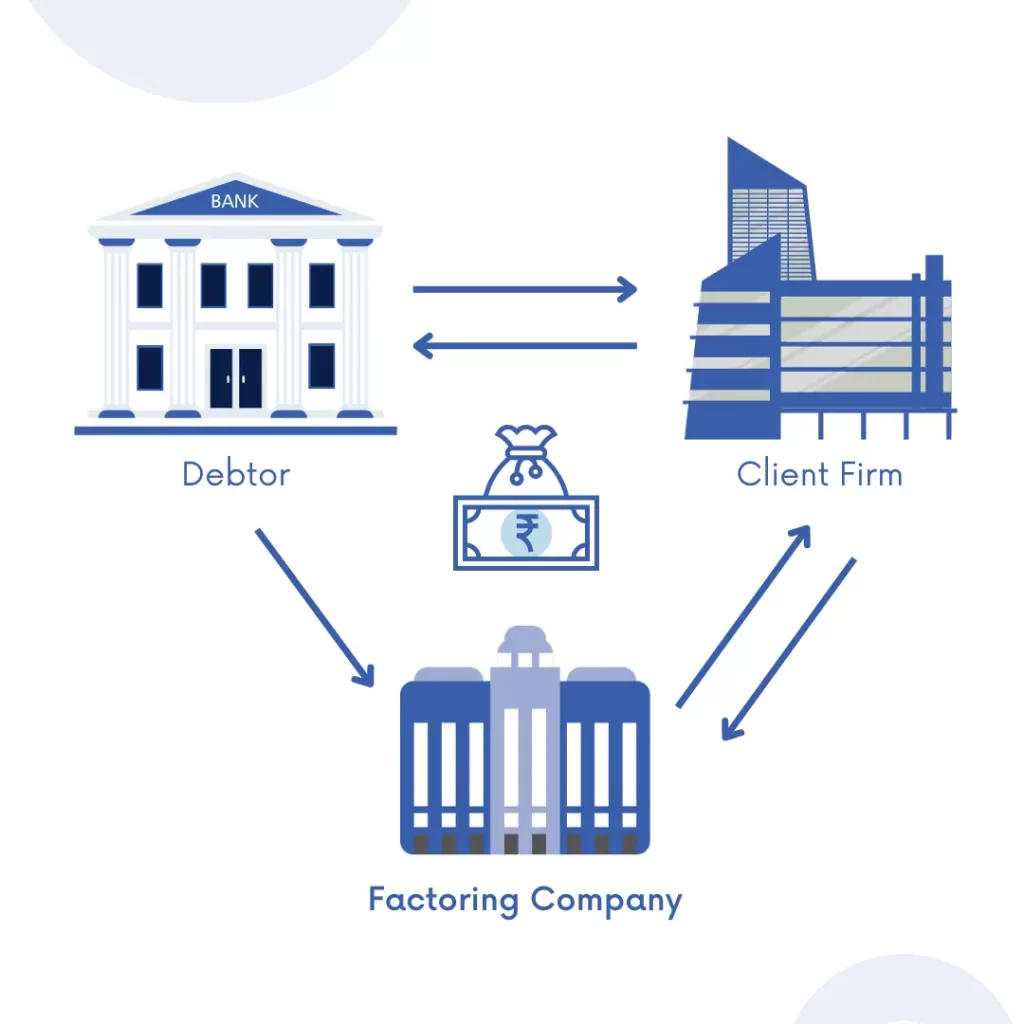

Factoring involves a business selling its debtors to a factoring company, which then manages the debtors and provides funds to the company, offering working capital support without requiring collateral.

As a business leader, you are aware of the importance of working capital for consistent growth and meeting market needs. Whether in manufacturing, services, or trading, adequate working capital is essential for success in the competitive modern environment.

Let’s schedule a brief call to discuss unsecured debt products for your business!!

This is very important, as documentation can be a significant factor in obtaining a Unsecured Debt facility. However, the length of the process is determined by the availability of documentation. Here’s the list:

1. Understanding Client's Requirement

A tailored funding solution based on a thorough evaluation of the client’s business goals and financial requirements.

2. Analysing the Strengths and Opportunities

Leverage the client's financial and operational strengths to optimize their funding prospects.

3. Documentation

Ensuring meticulous preparation of all necessary documents to facilitate a seamless funding process.

4. Identifying the Right Financial Product

Recommending the most suitable financial product to align with the client’s specific goals and requirements.

5. Soft Approval From Financial Institutions

Securing preliminary approval from financial institutions based on the client's profile and funding needs.

6. Actual Submission of the Documents

Submitting all finalised and verified documents to the financial institution for formal processing.

7. Disbursement

Coordinating with financial institutions to ensure timely release of funds.

8. Funding As Required

Providing funds customised to the client’s operational or expansion needs, ensuring business growth.

Check your CIBIL score for free.

We have had a smooth experience with all our capital arrangements facilitated via Terkar Capital so far. Its very comforting to work with people as professional and straightforward as Vishal and the rest of his team. Thanks for everything.

Thank you Terkar Capital for processing my business loan in just a few working days. Very professional & skilled team. They understood my requirements to a level that were beyond my expectations from any lending company. I strongly recommend Terkar Capital.

We are very thankful to Terkar Capital for your efforts in arranging facility. Their approach is very simple, professional, and fast! The team is highly responsive that executed the process in short span of time without any hassles. Great work... Thank you!

I got an unsecured business loan within 7 working days .their specialized experts verfied all the documents and granted me the loan .getting a business loan from terkar capital is the easiest way to get a loan.

Nashik | Nagpur | Chhatrapati Sambhaji Nagar | Hyderabad

Delhi | Bengaluru | Chennai | Kolkata | Ahmedabad | Surat

Growing Nationwide…