Working Capital Cycle (WCC) in Service Business

In service business, the working capital cycle (WCC) differs from manufacturing-based businesses, mainly due to the absence of tangible goods. This unique feature requires a fine-grained understanding and optimization of WCC to maintain functionality. Optimizing the working capital cycle is critical for service businesses to ensure liquidity, sustain ongoing operations and facilitate growth.

Defining the Working Capital Cycle

The working capital cycle in a service business context refers to the period it takes to convert net current assets and current liabilities into cash. It may be around 30-90 days.

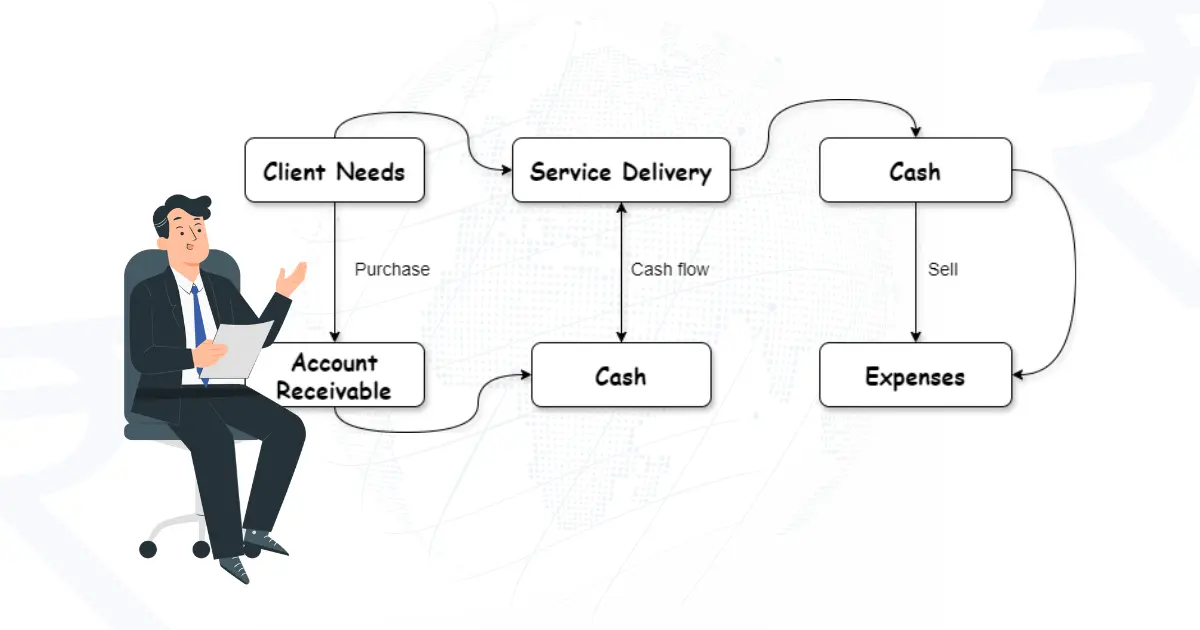

It’s the time between outlaying cash for labour and other operational expenses and receiving money from customers. The cycle typically involves several stages: procuring resources, delivering services, billing clients, and finally, collecting payments.

Learn the Strategies to Master Working Capital Cycle Management for Business Success

Components of the Working Capital Cycle in Service Business

The key to a healthy working capital cycle is to shorten the time between spending cash and getting it back. The faster you collect payments, the sooner you have money available for resources to deliver more services and keep the business running smoothly. Here are the components of the working capital cycle for service businesses.

1. Procurement of Resources:

In the service business, acquiring the necessary resources to deliver high-quality services is essential. This includes acquiring human resources such as staff recruitment and training, as well as intangible assets like technology procurement. Thus, these elements work together to provide the foundation for effective service delivery.

2. Service Delivery:

The service delivery phase is a crucial stage where the provider fulfils the client’s requirements. The duration of this phase depends on various factors, including the service complexity, nature, resources, client expectations, and external factors. So, effective communication and transparent expectations between the service provider and the client are vital for successful service delivery.

3. Billing:

After the service is rendered, invoices are generated. Efficient billing processes are crucial for shortening the WCC.

4. Collections:

The final stage is the collection of payments from clients. This can be a critical bottleneck, affecting the overall liquidity and working capital efficiency.

Learn from the Working Capital Cycle Insights here.

Optimizing the Working Capital Cycle for the Service Business

The service business generally has a less complex working capital cycle, because they typically don’t hold inventory. However, optimizing this cycle is still crucial for healthy cash flow. Here’s how service businesses can achieve this:

1. Streamlining Operations:

By improving operational efficiencies and reducing the time taken to deliver services, businesses can shorten their WCC. This includes investing in technology and optimizing workforce management.

2. Efficient Billing Systems:

Implementing automated billing systems ensures that invoices are generated promptly and accurately, reducing delays in the billing stage.

3. Effective Collections Management:

Establishing clear credit policies, offering multiple payment options, and proactive follow-up on overdue accounts can significantly improve cash flow.

4. Managing Payables and Receivables:

Balancing the payment terms with suppliers and clients is essential. Negotiating favourable terms can ensure that cash outflows and inflows are well-aligned, minimizing the working capital gap.

Conclusion

The working capital cycle is a crucial metric in service businesses, impacting their liquidity and overall financial health. By understanding and optimizing each component of the cycle, service-based businesses can enhance their operational efficiency, reduce financial strain, and support sustainable growth. Effective management of the working capital cycle ensures that service businesses remain agile, competitive, and resilient in an ever-evolving market landscape.

So, Partnering with Terkar Capital empowers you to focus on what you do best – delivering exceptional services – while we take care of the financial complexities of your working capital cycle.

Learn how working capital works here, in depth.