Working Capital Cycle (WCC) in Manufacturing Businesses

Manufacturing businesses have unique working capital cycles (WCCs). It significantly affects their operational success and financial well-being. Unlike WCC in service industries, manufacturing involves the management of tangible goods, which adds a complex layer to the WCC process.

Understanding and effectively navigating these cycles is critical to ensuring liquidity, efficient operations and sustainable growth in manufacturing businesses.

Defining the Working Capital Cycle

In manufacturing, the working capital cycle measures the time it takes to convert net current assets and current liabilities into cash. It spans from the initial cash outlay for raw materials and production costs to the collection of revenue from sales. It may be around 30-90 days.

The key stages include acquiring raw materials, producing goods, managing inventory, selling products, and collecting payments.

Learn the Strategies to Master Working Capital Cycle Management for Business Success

Key Components of the Working Capital Cycle in Manufacturing

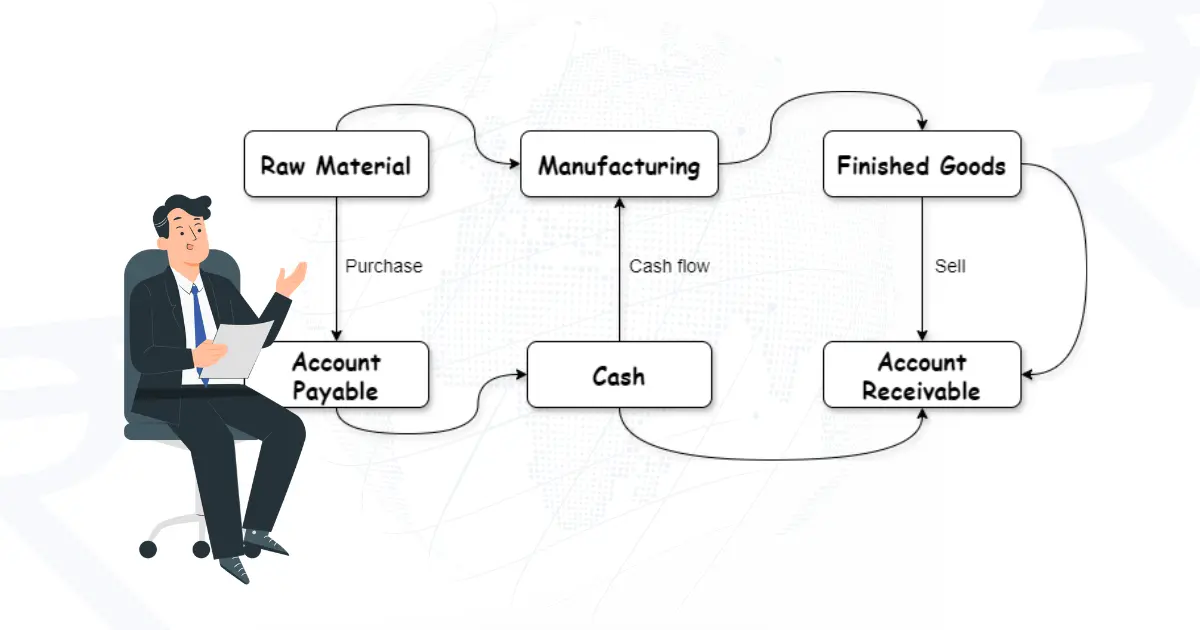

The working capital cycle in manufacturing is the continuous flow of a company’s resources as they are converted into cash. It shows how efficiently a manufacturer uses its current assets (cash, inventory, and accounts receivable) to generate revenue and cover current liabilities, such as accounts payable. Let’s understand the Key components:

1. Acquisition of Raw Materials:

This stage involves purchasing raw materials and components necessary for production. Effective procurement strategies and supplier negotiations are vital to controlling costs and managing cash outflows.

2. Production Process:

The manufacturing phase transforms raw materials into finished goods. The duration of this stage varies based on the complexity and nature of the products.

3. Inventory Management:

Finished goods are held in inventory until sold. Efficient inventory management practices, such as just-in-time (JIT) systems, can reduce holding costs and shorten the WCC.

4. Sales and Billing:

Once products are sold, prompt and accurate invoicing is essential. Streamlined billing processes ensure timely revenue recognition and advance the cycle.

5. Collections:

The final stage is collecting payments from customers. Effective credit control and proactive collection strategies are critical for maintaining cash flow and minimizing the working capital cycle.

Understand the Working Capital Cycle Insights here.

Optimizing the Working Capital Cycle in Manufacturing Business

The service business generally has a less complex working capital cycle, because they typically don’t hold inventory. However, optimizing this cycle is still crucial for healthy cash flow. Here’s how service businesses can achieve this:

1. Streamlining Production:

By adopting lean manufacturing practices and investing in advanced technology, organizations can increase production efficiency and reduce lead times, which can significantly reduce the working capital cycle (WCC).

2. Efficient Inventory Management:

Implementing just-in-time inventory systems and demand forecasting helps reduce inventory levels and lower holding costs, thereby shortening cycles.

3. Effective Billing Systems:

Automated billing systems ensure invoices are generated promptly and accurately, reducing delays and improving cash flow.

4. Proactive Collections Management:

Clear credit policies, multiple payment options, and diligent follow-up on overdue accounts can enhance cash flow and reduce the WCC.

5. Balancing Payables and Receivables:

Negotiating favourable payment terms with suppliers and customers helps align cash outflows and inflows, minimizing the working capital gap.

Conclusion

The working capital cycle is an important metric in manufacturing businesses, affecting liquidity and overall financial stability. By optimizing each stage of the cycle, manufacturing firms can improve operational efficiency, reduce financial stress and support sustainable growth.

Hence, Mastering the working capital cycle ensures that manufacturing businesses remain competitive, flexible and poised for long-term success in an ever-evolving market landscape. Hence, with tailored strategies, we at Terkar Capital are here to help you navigate and optimize your working capital cycle for maximum efficiency and growth.

Learn how working capital works here, in depth.