Bank Guarantee

Every business needs a backbone of funds. It is for its effective operations and to maintain the competition in the market. Moreover, there are several debt instruments available for funding. While Bank Guarantees are used the most. In this article, we’ll shed light on what is BG (bank guarantee), its key features, its process, and how it differs from the Letter of Credit.

What is BG (Bank Guarantee)?

The bank guarantee is a commitment provided by the buyer’s bank. It ensures that if the buyer fails to fulfill their obligations or make the payment, the bank will step in and make the payment, up to the specified amount mentioned in the guarantee. The lending institution offers Bank Guarantee (BG) as a financial instrument. However, the lender will ensure that the liabilities of a debtor will meet. In other words, the lender promises to cover a loss in case the borrower defaults on the loan. In the process of BG, four parties are involved in the transactions. Those are the applicant/ borrower, the issuing bank, the beneficiary and the beneficiary bank.

Features of Bank Guarantee

- BG builds confidence between the lender and the borrower. It adds assurance of transaction between an exporter and an importer. The primary reason for opting for BG is that many times the exporter and importer are unaware of transacting with each other. So, there can be a risk in the transaction. Hence, to overcome this risk involved, Bank Guarantee clears the hurdles.

- The BG obtain for a specified period. It is as per the need and requirements of the borrower. The applicant can hold the BG only up to a specified period, they can further renew it after maturity.

- The bank guarantee can or cannot hold assets against the instrument. The collateral depends upon the availability of the asset and the terms & conditions of the agreement between the lender and the borrower. It is also obtained without collateral.

Parties Involved in the Bank Guarantee Process

- The applicant (importer): who requests BG from his banker as per the demand from the beneficiary

- The issuing bank: as per the request from the applicant, the bank issues the BG on the beneficiary’s bank.

- The beneficiary (exporter): is the party who demands BG.

- The beneficiary’s bank: is the one who receives the BG on behalf of the beneficiary.

How does a bank guarantee work?

Example

“ABC Pvt Ltd” is an exporter company that deals with “XYZ Pvt Ltd”, and an importer. The exporter shipping goods requests the importer to get the Bank Guarantee from his banker. The banker on demand from the customer applies for BG and reduces the risk involved in the transactions. After receiving the BG, the applicant submits a copy to his other party which eases the procedure in the business operations. Here, “XYZ Pvt Ltd” is the applicant, the bank is an issuing party and “ABC Pvt Ltd” is a beneficiary.

In case of non-performance or default, the beneficiary can submit a claim to the bank. The bank evaluates the claim and, if valid, settles the claim by making payment or fulfilling the obligation as specified in the bank guarantee.

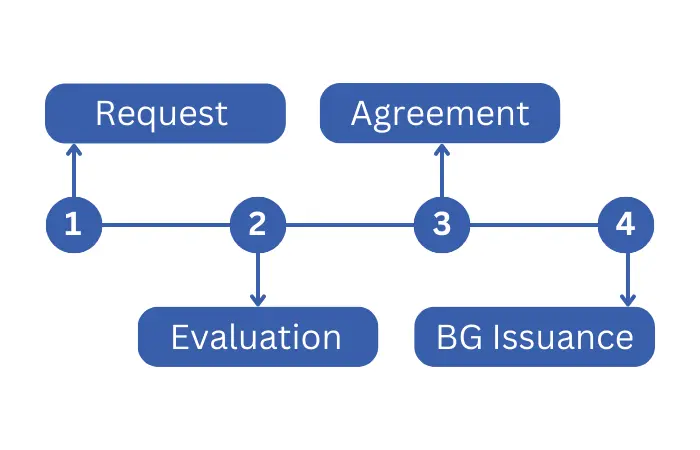

Apply for BG Instrument

- The parties while transacting with each other, the exporter demands BG from the importer.

- The importer requests his bank for the BG and submits the necessary documents.

- After preparing BG, the bank communicates the same to the importer.

- The importer then requests the bank to send the BG to the exporter’s bank.

- The exporter’s bank on receiving BG communicates the same to the exporter.

- The exporter then ships the goods towards the importer after receiving the BG from the importer.

Here is the case study of the Bank Guarantee Process.

Difference between a Bank Guarantee (BG) and a Letter of Credit (LC)

In the case of BG, payment has been made only in case of a default of the buyer. And, in the case of LC, payment has been made on behalf of the customer after receiving the goods.

In the case of BG, payment is made at the non-fulfilment of the transaction between the parties. Whereas the LC payment is made only after the fulfilment of the condition specified.

To learn the difference in details Read here.

Terkar Capital: Bank Guarantee Provider

At Terkar Capital, we specialize in assisting aspiring entrepreneurs and providing them with seamless funding solutions. While Bank Guarantee is among them. We understand the unique needs and expectations of our clients, and accordingly, we arrange and offer a wide range of financial products. Our team of experts is dedicated to guiding clients through every step of the funding process, ensuring their success while maintaining strict confidentiality.