As a developing country, India has a large number of micro and small enterprises. The Government of India has introduced the CGTMSE Scheme in response to this particular situation in the Indian economy. It has proven to be very beneficial for MSMEs to apply for business loans up to 5 cr under CGTMSE, assisting them in growing and revitalizing their businesses.

There is much more to the CGTMSE scheme. It has even encouraged aspiring entrepreneurs to give a push to their ideas and establish a firm. The manufacturing sector, which dominates the landscape of Indian MSMEs, has particularly witnessed the positive impact of the CGTMSE scheme. Thus, Entrepreneurs needing financial support can turn to the CGTMSE scheme. This will be an opportunity to obtain a 5 crore loan without collateral.

Government-backed Loan

Funding up to Rs 5 Cr with competitive rates

Credit Guarantee Cover without Collateral

Simple terms and less paperwork

Flexible Loan Repayment (Up to 60 Months)

To be eligible for a business loan under CGTMSE, you must meet certain criteria. These criteria may vary, but some of the essential requirements include:

Note: The eligibility criteria are common for applicants across India. However, there may be certain other criteria as well. Those are to meet specifically with the region or the financial institution that sanctions the loan.

CGTMSE loan documents vary from lender to lender. Also from case to case. However, in all scenarios, there is a standard set of documents. Those are as follows.

Get the CIBIL Score & the report for FREE.

The Government of India introduced the CGTMSE scheme in 2000 to support small businesses. It stands for Credit Guarantee Fund Trust for Micro and Small Enterprises.

The scheme aims at aiding Indian firms that are in their initial phases or fall under the MSME. It focuses on providing credit guarantees to financial institutions providing loans to MSMEs. Hence, an applicant owns a small/medium-scale business and gets a business loan without collateral of up to 5 crores under the CGTMSE scheme. However, there are certain eligibility criteria that the candidate needs to match.

The loan application is submitted to banks, which are then eligible to provide loans under the CGTMSE scheme. Government and private banks are involved in the scheme, which is available even in rural areas. So, here are the steps in obtaining a business loan under the CGTMSE scheme:

Terkar Capital, a reliable financial institution and your trusted CGTMSE loan consultant, offers hassle-free unsecured funding of up to 5 cr under the CGTMSE scheme. We provide personalized assistance to help business decision-makers understand the scheme thoroughly and make the best choice for their needs. Our commitment extends beyond the loan process as we value our relationship with borrowers. We strive to ensure their satisfaction with both the loan and our services.

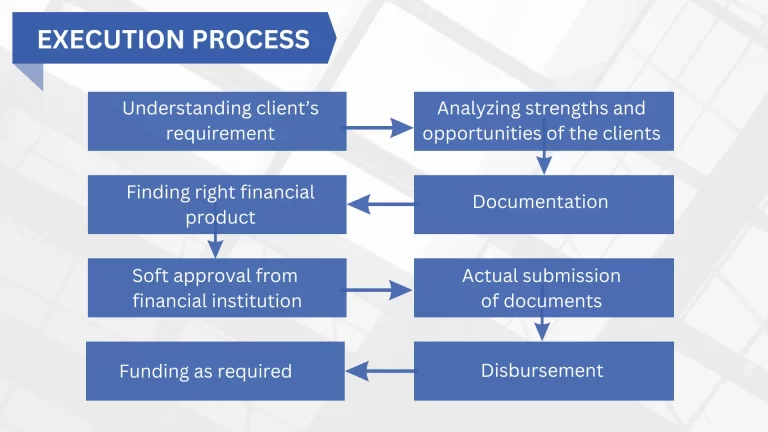

Here’s the execution process to avail of a business loan under CGTMSE smoothly at Terkar Capital.

We cordially track the deadlines and make our quality tangible, while executing finance projects well ahead of time.

We comply with the highest professional confidentiality standards. All client information is discussed in strict confidentiality.

We find you the right lenders with similar terms and the lowest rate of interest.

We create a stable ownership structure for financiers by establishing a secure transaction process.

We are building our reputation through reliability, integrity, and honesty. We connect to our clients on personal grounds that include transparency and liability.

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024