Trade Finance Company

All emerging businesses need a strong financial backbone to run efficiently. However, Many times, due to the lack of working capital, the business operation faces a downfall in its operations. That ultimately affects the whole functioning. While trading or dealing domestically or across borders, there are several necessary factors involved. Right from purchasing or manufacturing the product till receiving the final payment.

Trade finance companies aid businesses in both domestic and international markets by providing essential funds to tackle challenges and navigate complexities. These firms help manage risks associated with cross-border transactions efficiently.

What is Trade Finance?

Trade Finance provides the necessary financing for managing cash flows involved in domestic and international market transactions. It serves as a valuable tool for mitigating risks associated with cross-border trade. In such transactions, it is common for both the seller and buyer to be unfamiliar with each other, creating uncertainty and potential risks.

So, Questions arise: Will the buyer fulfil their payment obligations on time? Can we trust them to make the required payments? Fortunately, Trade Finance offers a solution to these concerns, providing the necessary assistance and ensuring smoother and more secure transactions. There is the involvement of two parties in a trade transaction:

(1) exporter who requires payment for their goods or services, and

(2) importer who wants to make sure they are paying correctly according to the quality and quantity of goods or services provided by the exporter.

Benefits from Trade Financing:

- Trade Finance helps in reducing the risk while dealing in the domestic as well as international markets. Being unaware of each other, both buyer and seller need a surety for a transaction with each other, which is solved by financial instruments used in Trade Finance.

- By choosing Trade Finance, the crunch of working capital will be resolved, which will increase the cash flow of the business. So, its main characteristic is working capital management which generates revenue and earnings for the business.

- The relationship between the buyer and seller is strengthened due to the availability of financial instruments like Bank Guarantees, LC Discounting, Factoring, etc. The financial instruments gain confidence between parties and build a relationship due to the guarantee given by a bank or a Financial Institution.

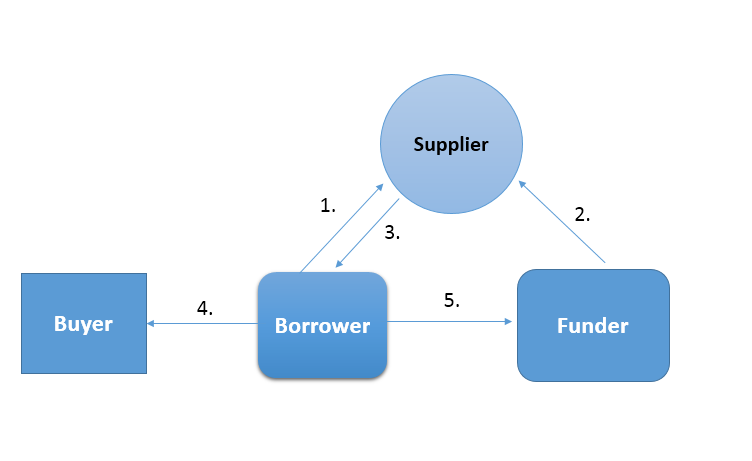

Process in the Trade Finance Company

- Borrower agrees to purchase the goods from a supplier.

- And he agrees to terms with the funder and the funder pays the agreed amount to the supplier.

- The supplier then ships the goods to the borrower.

- After receiving goods from the supplier, the borrower sold the goods to the buyer and receives payment for the goods.

- The borrower then repays the money back to the funder.

Understand the Process of Trade Financing Provider from the Case Study.

Parties involved:

A borrower is a person who is in the trading business and needs funds for trading activities.

The buyer will buy goods from a borrower/seller.

Due to the lack of funds, the borrower seeks finances for trade from the funder/lending institution.

The supplier is the person who supplies goods to the borrower who then sells goods to the customers.

Trade Financing Instruments

Factoring is available to domestic as well as international customers. It is the financial instrument or debtor finance in which the seller sells its accounts receivable to a third party called ‘factor’ at a discount. There are three parties involved in such a transaction: a seller, a buyer, and a factoring company. In simple words, it is selling unpaid invoices for the requirement of instant cash.

A line of credit / Letter of Credit is a guarantee that a financial institution provides to pay sellers on behalf of buyers in case of default on their part. Letter of Credit discounting serves as financial security for businesses involved in either export or import or both.

Bank Guarantee is a type of financial instrument that banks or Financial Institutions offer. It ensures the liabilities of the debtor will meet i.e, the bank will be held responsible for the non-payment of the debtor. Generally, it is a bank’s promise to a third person. So as to undertake the payment risk on behalf of its customers. The banker charges interest or fees on such an instrument which is based on the risk involved in the transaction.

Terkar Capital: Leading Trade Finance Company

Trade finance is the financing for undertaking trade to the clients working at the domestic as well as international level. The process is complicated, but we at Terkar Capital make it convenient for our clients.

As a leading trade finance company headquartered in Pune, with a corporate office at Mumbai BKC. However, we operate in almost all major cities in India. At Terkar Capital, we arrange several options in both debt and equity funding. We analyze all the aspects of the business and then suggest appropriate products according to the financials. Our reliable and efficient process sets us apart from other trade finance companies.

I’m International Trade finance consultant based in Delhi with 30+ years experience. I’m dealing with importers, exporters, traders &manufacturers. I can refer you proposals of my clients requiring various trade finance facilities. Please confirm and whatsapp procedure. 🙏

G. M. Rai Consultant International Trade and Finance

Dear Mr. Rai,

Thank you for your inputs. For further conversion request you reach out us, here.

Thank you.