John decided to take a loan from a trade finance provider to help his company enter the international market. According to his analysis, he will require Rs. 5 cr to kick start his business internationally starting with the US. He approached some financial institutions but they refused. Unfortunately, he did not have any assets or property which he could keep as collateral with the financial institution.

Here he was not very clear on what kind of funding he should take to have an international jump. But he just needs the funds, maybe in a term loan or maybe in working capital Financing. The bottom line was very clear, he wanted to have funds for the business. Hence, John realised that trade finance providers could help him navigate the complexities of international business expansion.

| Company Turnover | Rs. 50 Crores |

| Amount Required | Rs.5 Crores |

| Mortgage Availability | No Mortgage |

| Company Industry | Food Industry |

| Reason For Requirement | Starting Export |

While discussing this plan with one of his business colleagues, he recommended Terkar Capital for financial advice and debt funding arrangements. After he gets in touch with one of our experts, We set up a meeting with John to discuss his financial requirements. We recommended a trade finance solution, after analyzing his business situation.

Trade finance is the financing of international trade flows. It reduces the risks involved in international trade transactions. This financial instrument helps you to bridge the gap between you and your export business working capital. We at Terkar Capital understand the challenges that a businessman may face and thus we make sure that you get your funding even though you do not have collateral.

Unlocking global opportunities with a trade financing company and scaling your business

We explained the entire procedure to John. Once the picture was clear on both ends, we started the execution. The process of trade financing started when we received the Purchase Order (PO). We then completed all the required documentation about the export. Upon shipment of the goods, the financial institution released the amount to John.

There is sometimes risk involved while dealing with international customers, especially if it’s the first time. When John shipped his goods he was paid almost 90% of the invoice amount. Once the customer made the payment to the financial institution, John received the remaining balance.

John was also worried about the ROI that the financial institution would charge. Terkar Capital looked after that too! The interest was started after he received the amount until the customer made the payment. The financial institution stopped charging interest as soon as it received the payment from the client. He got a good amount of export finance as his first customers were in the US. Now because of exports, the turnover of the company is growing. Mr John is absolutely happy with both the decision to start exporting and Choose Terkar Capital for financial aid.

| Business Commencement Year | 2014 |

| Amount of Funding | Rs. 5 Crores |

| Total Execution Time | Working Days. |

| Customer Service Experience | 4.4/5 |

| Country of Export | US |

John, the owner of JK Foods Private Limited, a successful food products company, is determined to expand internationally despite his challenges. He recognised the need for a trade finance provider, so he approached Terkar Capital for assistance. Understanding his situation and the risks involved, we recommended a trade finance solution to bridge the gap in working capital for his export business. With no collateral available, Terkar Capital successfully met John’s funding needs.

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

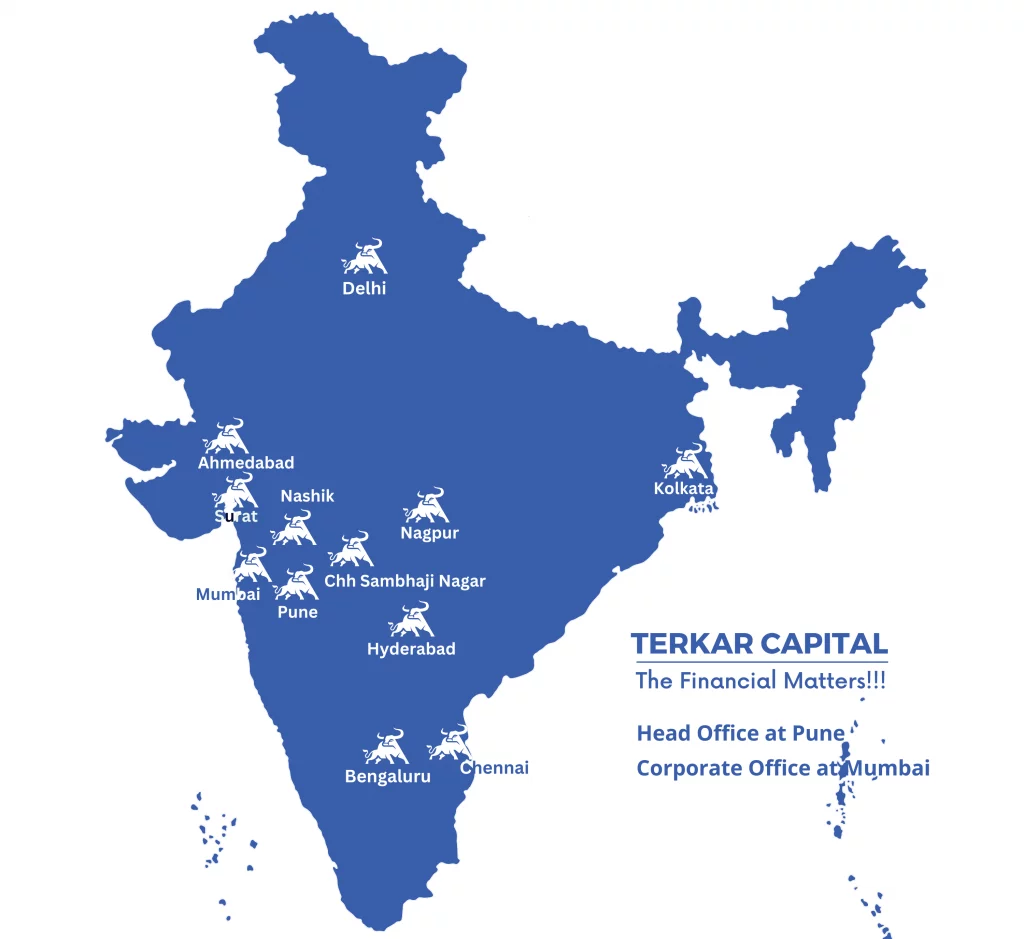

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024