Machinery Loans for MSMEs are crucial in driving India’s economic growth. Unfortunately, these enterprises often face obstacles due to insufficient capital, which hinders their progress. Many businesses struggle to compete with more prominent industry players and eventually fail. So, Machinery can be a great asset for MSMEs, providing several benefits that can help them grow and succeed. Hence, for businesses, a Machinery loan is a valuable financial tool.

The Machinery Loan, also known as Machinery Lending or Machinery Finance, acts as a saviour for your business, providing a much-needed boost. It allows MSMEs to easily obtain loans for machinery purchase, facilitating the acquisition and upgrade of equipment and ultimately propelling their business to grow.

Funding Amount Starting From 25 Lacs to 10 Cr

Competitive Interest Rates

Smooth Processing

Simple terms and less paperwork

Easy Documentation

To secure approval for Machinery Loan for MSMEs in Pune, the following documents are required. Please note that additional documentation may be requested by the lending institution:

Provided you meet the eligibility criteria, financing machinery is a relatively straightforward process that can be completed in a few simple steps:

The first step is to understand what type of machinery you require, what amount you may contribute and what is the requirement of the funds.

Having a good credit score is one of the major parts of eligibility if the unit is new and in case you have the existing unit, you may need to check the financial ratios.

Once you’ve understood the eligibility, submit a proposal for debt funding. This must contain information about your company, the machinery you plan to purchase, the total amount of funds you require, etc.

To consider the proposal in detail, you need to submit the proposal. This should include company / firm KYC, owner/shareholder/partner’s KYC, Financial Documents, GST Returns and machine quotation.

MSMEs play a vital role in India’s growth but face funding challenges. That’s where our expertise in Machinery loans for businesses comes in. A loan against machinery is a term loan that allows MSMEs to purchase state-of-the-art equipment to increase productivity. Hence, we at Terkar Capital, specialize in providing effortless heavy machinery financing in India. It provides small or medium-sized businesses the capital they need to grow and compete.

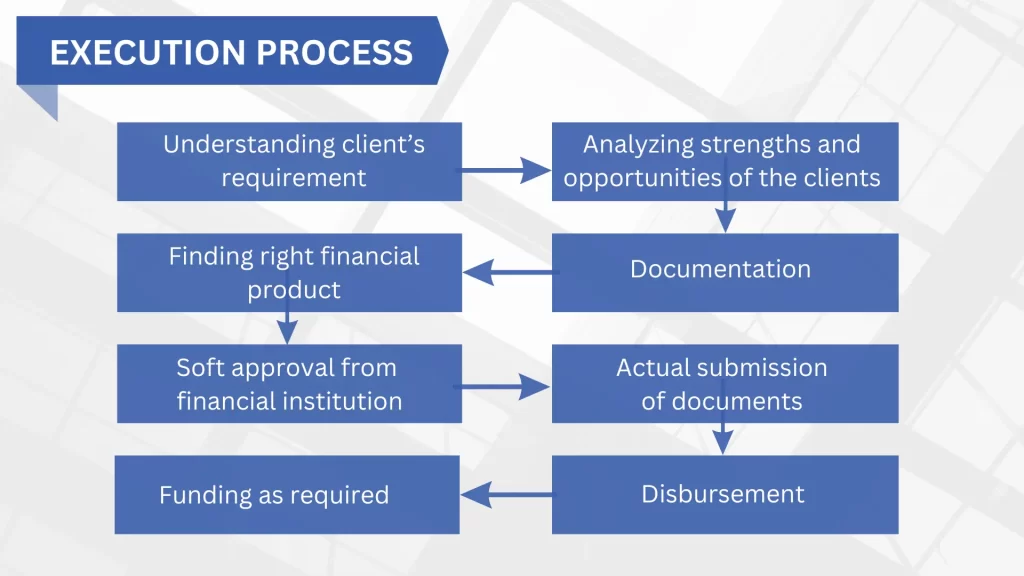

A Loan against machinery can be used for a variety of purposes, depending on the needs of the borrower. Here is the process:

We cordially track the deadlines and make our quality tangible, while executing finance projects well ahead of time.

We comply with the highest professional confidentiality standards. All client information is discussed in strict confidentiality.

We find you the right lenders with similar terms and the lowest Machinery Loan interest rate.

We create a stable ownership structure for financiers by establishing a secure transaction process.

We are building our reputation through reliability, integrity, and honesty. We connect to our clients on personal grounds that include transparency and liability.

Yes, Machinery loan facilities can be obtained with or without the need for collateral or assets.

The Machinery Loan interest rate is highly flexible and attractive, starting at 10.5% per annum, subject to financial ratios.

We understand that you need a loan for machinery purchase, to either acquire new equipment or enhance your existing machinery. So, we conduct a financial SWOT analysis of your business and utilize the results to secure the necessary funds for your specific requirements.

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024