Letter of credit discounting

To ensure the smooth running of your business operations daily, it is crucial to have sufficient working capital. This means that your company may need to consider obtaining loans, either in the short-term or long-term. In the past, all the loans obtained were secured, but now we have a range of options, including both secured and unsecured loans. Let’s focus on one particular working capital instrument called Letter of Credit (LC) discounting.

Overview

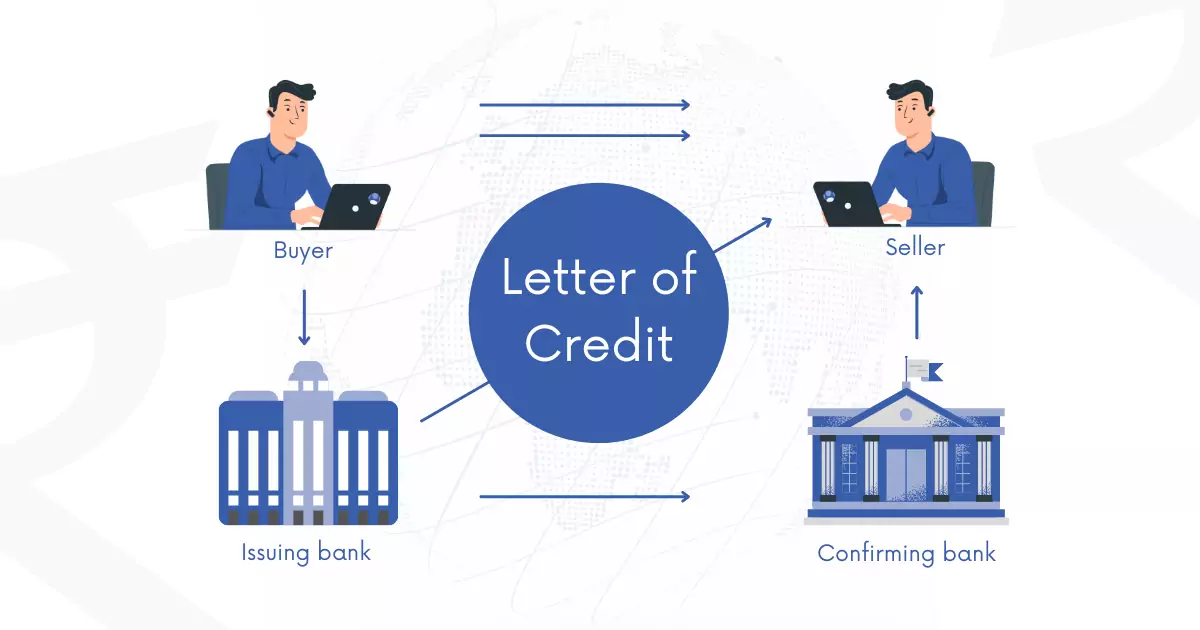

A banker issues the letter of credit as a financial document. In this Bank gives a guarantee to pay the seller for the buyer’s obligation, In case a buyer fails to make the payment. Hence, LC discounting takes away the risk.

LC gives assurance to the seller of the funds. It is an unsecured debt product used in international trade. Mainly where the buyer and seller are unknown and have to risk in a transaction between each other. There is involvement of major 4 parties in such a transaction. Namely: Exporter, Exporter’s Bank, Importer, and Importer’s Bank. A buyer and seller both request LC. So, both of them mutually decide the terms and conditions.

Features of LC discounting

- It speeds up cash flow and improves working capital management.

- It mitigates transaction risk and assures both parties.

- The LC is discounted once the buyer’s payment is verified.

- LC is available for both domestic and international customers but is primarily used in international transactions.

- Strong relationships between exporters and importers facilitate smooth LC discounting operations.

- Following are the benefits to the parties.

- A Seller gets immediate cash flow for his business.

- A buyer gets a credit period for making payments.

- The bank receives interest for the said services.

Letter of credit discounting Process

In the case of a manufacturing or trading company, the sellers may require funds immediately. He cannot wait for the due date. So, in such a case, LC Discounting plays a major role in assistance to the eligible sellers. Here’s a general process:

- Buyers on demand from the seller request a Letter of credit (LC) from the respective banks before the shipment of goods. And send the same to the seller/exporter bank.

- The exporter bank checks the document and communicates the acceptance to the seller.

- The exporter receives the Letter of Credit and requests it for discounts.

- Hence, the bank discounts the LC after deducting the charges or discounting fees. The exporter gets the money and uses the same for his business expenses.

Learn the process of LC discounting from the case study.

Example

Let us suppose that “ABC Private Ltd” company engaged in manufacturing situated in India. The company receives an order of goods from a foreign country “XYZ Private Ltd”. It is asking for a credit period of 60 days for the payments of goods.

Being unknown to each other, “ABC Pvt Ltd” demands a Letter of Credit from “XYZ Pvt Ltd”. It sends it for confirmation to “ABC Pvt Ltd”. It will check the letter and accept it. And can discount the same. Thus, by discounting the LC, the seller will get immediate cash flow. So, he does not have to wait till the end of the credit period.

LC discounting at Terkar Capital

Terkar Capital facilitate a letter of credit discounting. This financial instrument provides working capital to businesses without the need for collateral.

In a letter of credit discounting, a bank issues a guarantee to pay the seller if the buyer fails to make the payment. This reduces the risk for both parties involved in international trade transactions. LC discounting improves cash flow and working capital management for businesses while ensuring a smooth transaction process. Both domestic and international customers can benefit from letters of credit, and it helps build a strong relationship between exporters and importers.

FAQs on Letter of Credit Discounting

1. Can businesses transfer a letter of credit?

Yes, a letter of credit can be transferred. There is a special kind of LC which is called a transferable letter of credit. It includes a transferrable provision. Transferable LC additionally allows the first beneficiary to transfer some or all of the credit to another party, which creates a secondary beneficiary.

2. Is a letter of credit discounting safe?

A Letter of credit is one of the safest options and is most commonly used in domestic and international business transactions. In fact, the exporter or importer, who are unknown to each other from different locations at such times the buyer’s creditworthiness can be checked through LC. So, it is a safe and widely used working capital instrument.

3. Can a letter of credit be canceled?

There are various types of LC, depending upon which can or cannot be cancelled. For example:

- A revocable letter of credit can be cancelled or amended by the issuing bank at any time and without prior notice to or consent of the beneficiary.

- An Irrevocable Letter of Credit cannot be cancelled or amended without the consent of all parties concerned.

4. How does a letter of credit discounting work?

A letter of credit is a letter issued by a bank guaranteeing that the seller will receive the payment from the buyer on time with a given amount and in case the buyer fails to make the payment, the bank will be paying the amount to the seller. So, it works like a trust factor between importer and exporter.

5. Who can issue a letter of credit?

Issuing bank (importer’s bank) which issues the LC when an applicant (importer) requests the bank to issue the LC. Generally, LC with a well-rated bank is accepted.

6. What is the expiry date of the letter of credit?

The last date to submit the exported documents with the bank for negotiation of documents is called LC expiry. Here, the exporter needs to submit all required documents with the bank after export as per the guidelines mentioned in the letter of credit. This means if shipped goods before the date mentioned in LC for shipment, the Letter of Credit is void, but not submitted documents for negotiation within the validity period of the Letter of Credit.

7. When is the requirement of LC?

The main requirement of LC is when the parties are unknown. And have to take risks in transacting with each other. So, LC discounting is used mostly in international transactions.

8. Who can avail LC Discounting facility?

All the eligible businesses who are engaged in manufacturing or service industries can apply for such a facility. It can include selling or shipping goods, trading businesses, or other related businesses.

9. How much is the interest charged for discounting?

The interest/fees depend upon the amount of the transaction, the Credit score of the buyer, the history of the debtor, etc. It varies according to the clients.

10. What are the documents required for discounting LC?

The documents include shipment and insurance bills and Bank issued original LC.

Lc discounting

Hello Pratik,

We can help you with LC discounting instruments. We request you reach out to us by contact us page. Thank You.

Nice informative article,well done.