Businesses often find themselves in need of funding for various purposes. Be it for business expansion, starting a plant, buying machinery, or any financial requirement. Sometimes the requirement might be so large that a single lender or bank will not be able to provide for themselves. So, how do you address such a situation? Well, this is where debt syndication loans come into play.

Thus, by allowing multiple lenders to provide sections of the entire loan amount, it allows you to obtain large amounts of funds. Let’s explore the execution of debt syndication services in India.

Multiple lenders, one agreement

Loan structures and Rates are flexible

Terms range from 3 to 15 years

Fast and easy for borrowers

Borrowers contact the syndicator, not lenders

Although the exact documentation will depend on the requirements of the syndicate agent, the following are the general documents you will require:

Learn Myths about debt funding here.

When it comes to hassle-free and reliable debt syndication services in India, look no further than Terkar Capital. As a leading debt syndication company, we offer meticulous product analysis and carefully select suitable lenders for the syndication process. With a focus on efficiency, we ensure quick turnaround times and ensure funds are available when you need them.

Our experienced team takes care of every aspect of the syndicate process, ensuring a seamless and comprehensive implementation. So, Bet on Terkar Capital for all your loan syndication needs in India.

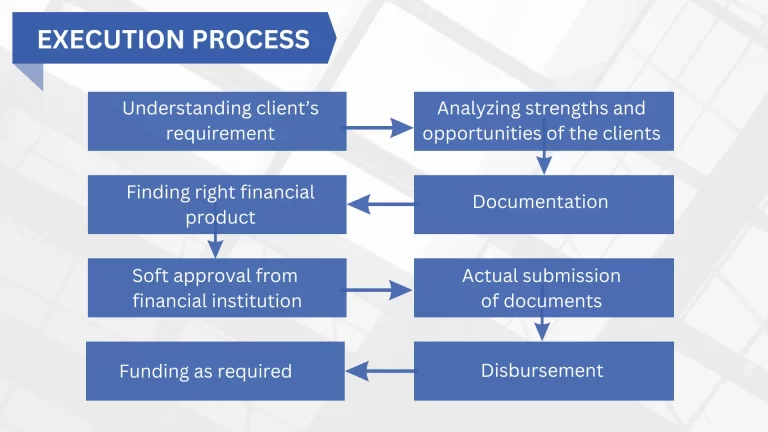

Here is the process to apply for a debt syndication facility:

We cordially track the deadlines and make our quality tangible, while executing finance projects well ahead of time.

We comply with the highest professional confidentiality standards. All client information is discussed in strict confidentiality.

We find you the right lenders with similar terms and the lowest rate of interest.

We create a stable ownership structure for financiers by establishing a secure transaction process.

We are building our reputation through reliability, integrity, and honesty. We connect to our clients on personal grounds that include transparency and liability.

Debt syndication simply helps businesses to acquire a large number of loans. Generally by accumulating different amounts from multiple lenders instead of one lender. A leading syndicate firm manages this structured product. Large businesses used debt syndication services earlier. But today even SMEs require large funding. With an increasing number of enterprises in India, the need for large amounts of funds is only likely to grow.

A consortium is successful when one single financial institution cannot fund the loan amount to the borrower. Various financial institutions club together to supervise the said loan amount. A consortium unlike syndication is not built to deal with international transactions. A consortium is usually bound by a legal contract. It delegates responsibilities among its members.

It also involves multiple lenders and a borrower. But it generally involves international transactions and sometimes different currencies. syndication of loans usually headed by a managing bank. It has been approached by the business to arrange the credit. This managing bank is generally responsible for negotiations of conditions and arranging the loan.

India is a booming economy. With several businesses coming up and the youth focusing on starting enterprises, the requirement for funding is inevitable. The growth is so fast that the funds may be needed in large amounts. The first solution that comes to mind in such a solution is equity funding. However, there is a problem with equity. The ownership of the company diluted the investors, leading to the decreasing claim of the founders of the company. This is where the need for debt syndication is essential.

Debt syndication allows businesses to acquire funding without having to give up on their claim to their own company.

Another reason to get a debt syndication loan is that in normal loans a lender can only provide a certain amount to a borrower depending on their capabilities and other factors. In cases where the funding required is beyond this limit, the syndicate firm arranges multiple lenders. Each of the lenders provides portions of the loan amount.

Eg:- Your company requires 50 crores. And none of the lenders can lend that amount alone. Then a debt syndicate company can acquire you 10 crores from lender A, 20 crores from lender B, 10 crores from lender C, and so on.

If you’re confused about how to get a loan through debt syndication, here’s how the process of debt syndication works:

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024