Mr Kamdar is the promoter of Megaprojects. The company works on many private company projects and wants to extend its operations into government projects. Projects including road construction, dam construction, etc. So, whenever there are any such projects with the government, the government issues the tender. Thus, when the government issues the tender, it always has the condition of a performance bank guarantee. In July, the state government issued the tender to complete the state road highway project of 100 Km with a budget of Rs. 350 crore, where the contractor has to submit a 10% performance bank guarantee for bidding. Let’s understand the bank guarantee process.

Mr Kamdar wishes to bid for this tender. So, he has to submit the bank guarantee of Rs. 35 crores. Mega-projects have a working capital facility of Rs. 50 crores with the State Bank of India, but this limit given by the bank was limited to Cash Credit (CC) only. And Mr Kamdar has given all the available mortgages to SBI for the same. He was confused. He needs the bank guarantee but does not have the same. This tender will help his company to achieve better growth in the future. So this deadlock condition for Mr Kamdar and his company.

He discussed this situation with his best business friend — Mr Joseph. Mr Joseph has been in government contracts for the last couple of decades and worked on many government projects. He suggested to Mr Kamdar to get help from Terkar Capital. Earlier when Mr. Joseph encountered the same condition, he took good help from Terkar Capital and benefited a lot.

Company Turnover Rs. 350 Crores Company Industry Infrastructure Projects Mortgage Available Rs. 50 Crores Amount Required Rs. 35 Crores Facility Required Bank Guarantee.

When Mr Kamdar approached the Terkar Capital team. Terkar Capital understood the whole business scenario, they analyzed the financials of the company. They found Mr Kamdar and his company have a collateral value of Rs 35 crores and he has already taken the CC exposure of Rs. 50 crore. They also analyzed that Mr Kamdar also has a good repayment track record. Thus, Terkar Capital suggested and executed the working capital option where Mr Kamdar has a working capital facility of Rs. 45 crores in terms of CC, and Bank Guarantee arranged the exposure of Rs. 35 crores with the available mortgage.

This is the best solution Mr Kamdar had received to come out of the deadlock condition. He submitted the government tender with the applicable performance BG and he won the tender as well. Because of this tender, Mr Kamdar has increased his turnover to a larger extent, and all the stakeholders of his business benefited a lot.

Do reach out to us with any questions or doubts. To ensure that you get the best service, please contact us before visiting.

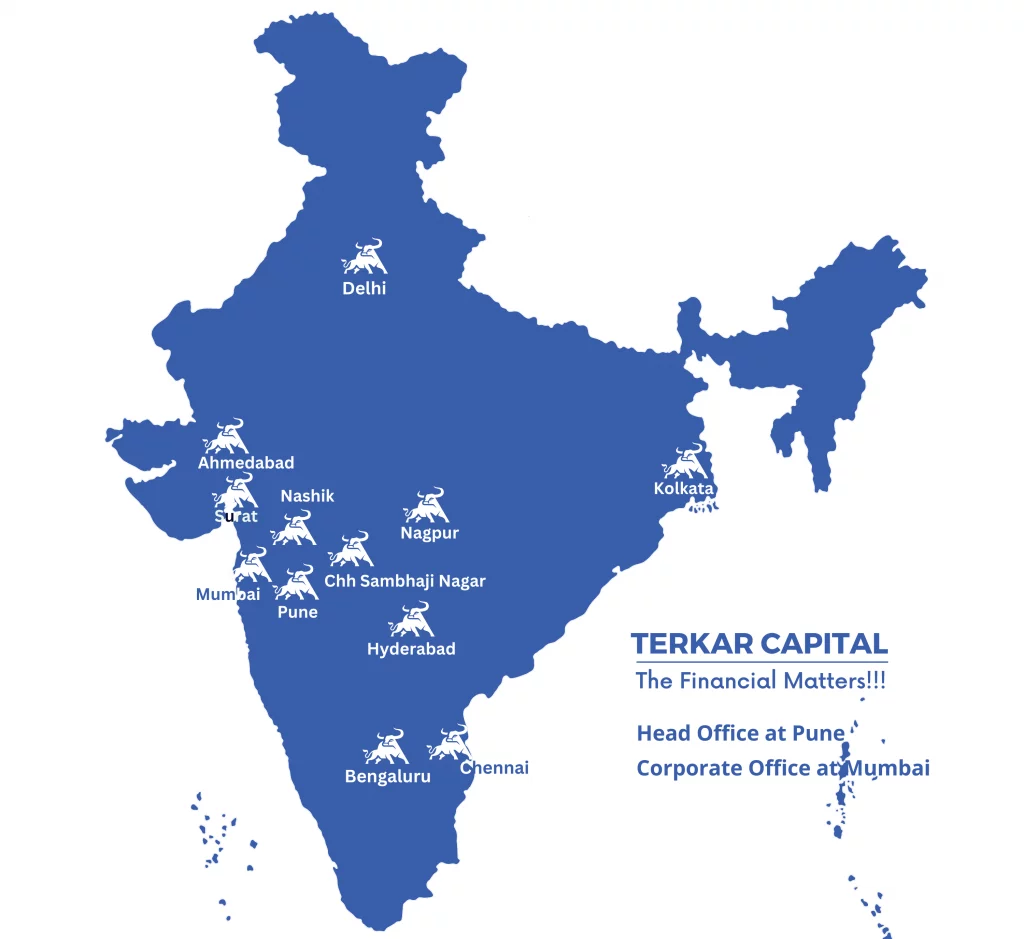

Terkar Capital is a registered brand of Terkar Global Financial Development Pvt Ltd, is an Investment Banking Firm with a national footprint. We work extensively with professionals and businesses of all sizes to arrange debt funding instruments.

Castle Eleganza, 103, Bhonde Colony, Dr.Ketkar Road, Erandwane, Pune – 411004 [MH-India]

The Capital, Level 7, B-Wing, Plot C – 70, G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 [MH-India]

Delhi | Bengaluru | Chennai | Hyderabad | Kolkata | Ahmedabad | Surat

© Terkar Capital 2024